You worked hard for your income, but the numbers on your paycheck feel smaller than ever in 2025. Is all that stress worth it?

If you’re earning $150,000 or more yet still feel financially squeezed, you’re not alone. Over 36% of high earners live paycheck-to-paycheck despite six-figure salaries, and 77% report losing sleep over finances. Understanding your 200k salary breakdown isn’t just curiosity-it’s the first step toward financial control for HENRYs (High Earners, Not Rich Yet) in today’s economy.

The Hidden Drain on High Incomes

The gap between gross salary and actual spending power has never been wider for professionals in major metros. A household earning $250,000 in New York City or San Francisco might assume they’ve achieved financial security, but the math tells a different story.

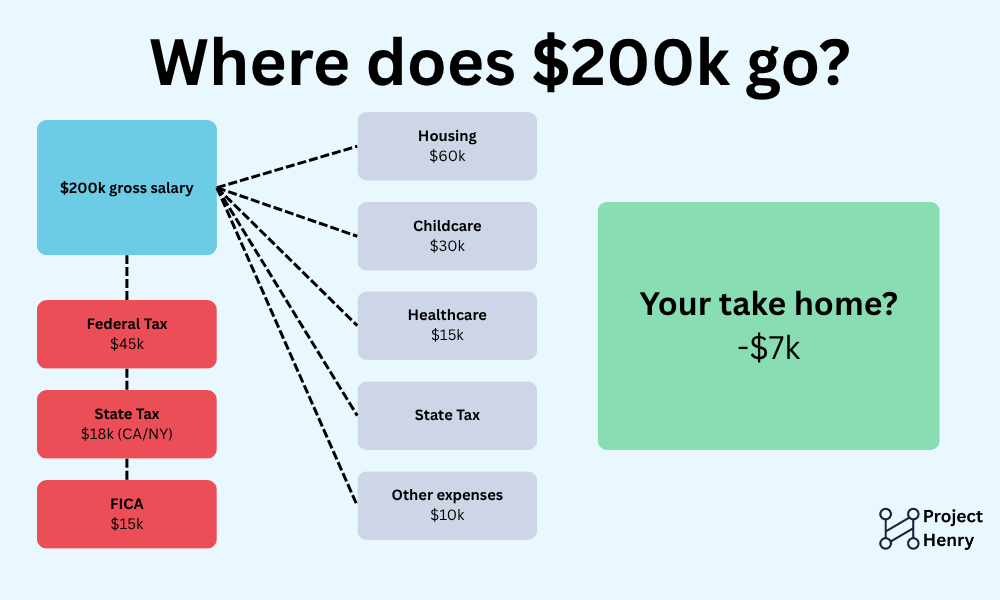

Federal taxes alone place most HENRYs in the 32% or 35% bracket, and state taxes in California or New York add another 9-13%. FICA taxes take an additional 7.65% on earnings up to $176,100 in 2025, with Medicare taxes continuing beyond that threshold. The result? An effective tax rate approaching 40-50% before a single dollar reaches your bank account.

But taxes are just the beginning. Housing costs in top metros often consume 30-40% of gross income, childcare can run $2,500-$4,000 monthly per child, and the $10,000 SALT deduction cap means high-property-tax states offer little relief. Student loans, health insurance premiums averaging $1,200+ monthly for families, and lifestyle expenses quickly absorb what remains.

Understanding Your 200k Salary Breakdown in 2025

In 2025, federal brackets range from 10% to 37%, but marginal rates don’t tell the full story. When examining a typical 200k salary breakdown, the numbers reveal why high earners feel financially stretched. In 2025, federal brackets range from 10% to 37%, but marginal rates don’t tell the full story. A married couple filing jointly hits the 32% bracket at $394,600 and the 35% bracket at $501,050.

The Alternative Minimum Tax (AMT) remains a trap for dual-income professionals, especially those with high state and local taxes, large mortgage interest deductions, or incentive stock options. Many tax credits and deductions phase out entirely at HENRY income levels-child tax credits, student loan interest deductions, and dependent care credits often provide zero benefit for households earning $200,000+.

FICA adds another layer: Social Security tax applies at 6.2% on earnings up to $176,100, while Medicare tax continues at 1.45% on all income, with an additional 0.9% surcharge for single filers earning over $200,000 (or $250,000 for joint filers).

Your Secret Weapon: The Take-Home Pay Calculator

Before accepting that next raise, changing jobs, or making major financial decisions, understanding your true after-tax income is essential. A specialized take-home pay calculator designed for high earners does more than basic math-it provides a complete 200k salary breakdown revealing optimization opportunities most professionals miss.

The 2025 Take-Home Pay Calculator accounts for federal tax brackets, all 50 state tax rates, FICA calculations, and-critically-pre-tax deduction optimization. By modeling scenarios with different 401(k) contributions, HSA funding, and health insurance elections, you can see exactly how strategic pre-tax deductions reduce your tax burden while building wealth.

Practical Moves to Keep More Money

The difference between passive and strategic tax planning can save high earners $10,000-$30,000 annually. Start with these evidence-based strategies:

Max out tax-advantaged accounts: The 2025 401(k) contribution limit is $23,000 ($30,500 if you’re 50+), with total contribution room of $69,000 including employer match and after-tax contributions. For a high earner in the 35% bracket, maxing your 401(k) saves $8,050 in federal taxes alone.

Leverage your HSA: If you have a high-deductible health plan, HSAs offer triple tax benefits-pre-tax contributions, tax-free growth, and tax-free withdrawals for medical expenses. Family coverage allows $8,550 in contributions for 2025, with an additional $1,000 catch-up if you’re 55+.

Consider salary sacrifice strategies: Converting taxable compensation into pre-tax benefits-whether retirement contributions, HSA funding, or qualified commuter benefits-directly reduces your taxable income. Use a calculator to model the impact before your next benefits enrollment.

Review state tax residency: For mobile professionals, state income tax differences are substantial. Moving from California (13.3% top rate) to Texas or Florida (no state income tax) can save a $300,000 earner $40,000+ annually.

Real Numbers: A Complete 200k Salary Breakdown

Consider a dual-income household in a high-tax state-one partner earning $180,000, the other $120,000, for $300,000 combined. Without optimization, their 200k salary breakdown shows roughly $192,000 in take-home after federal, state, and FICA taxes-a loss of $108,000 to taxation alone.

By maxing both 401(k)s ($46,000), contributing to family HSA ($8,550), and utilizing pre-tax health insurance ($12,000 annually), they reduce taxable income to $233,450. Their new tax bill saves approximately $24,000 in federal taxes alone-money that compounds in retirement accounts while reducing current stress.

The monthly difference? An extra $2,000 that would have disappeared to taxes now builds a $2 million+ retirement nest egg over 25 years at 7% average returns.

Building Wealth Beyond the Paycheck

Understanding where your money goes is only the beginning. High earners who successfully build lasting wealth share three common habits: they automate their savings before seeing the money, they maintain 20-25% savings rates regardless of income increases, and they resist lifestyle inflation with each promotion or bonus.

The path from high income to true wealth requires intentional decisions at every stage. Many professionals reach six-figure salaries but remain financially fragile because they’ve never created a systematic approach to wealth building. Setting up automatic transfers to investment accounts, establishing clear financial milestones, and reviewing progress quarterly transforms abstract goals into achievable outcomes.

Consider diversifying income streams beyond your primary salary. High earners often possess valuable skills that translate to consulting work, board positions, or expert witness opportunities. These additional revenue sources not only provide financial cushion but accelerate wealth accumulation when properly structured and taxed.

Your Next Steps Toward Financial Independence

Breaking free from the paycheck-to-paycheck cycle-even on a high salary-requires clarity, systems, and accountability. Start by using the 2025 Take-Home Pay Calculator to understand your true baseline. Then model different optimization scenarios to see exactly how much various strategies could save.

Download our free High Earner Tax Optimization Checklist to ensure you’re capturing every available opportunity this year, and join the HENRY Insider email list for weekly advanced strategies tailored to six-figure professionals navigating the same challenges you face.

Ready to optimize further? Explore related guides:

- How to Maximize Your 401(k) Contributions as a High Earner

- What is a HENRY? Financial Challenges in 2025

- FIRE Planning for HENRYs: Step-by-Step Guide

Disclaimer: This article provides general information only and does not constitute personal financial, tax, or legal advice. For personalized tax and financial guidance, consult a qualified CPA or financial advisor who understands your unique situation. All tax rates and contribution limits are current as of 2025 and subject to change.