- 1. Introduction: Why High Earners Still Feel Broke

- 2. 401(k) Basics Refresher (With 2025 Updates)

- 3. Why Maxing Out Your 401(k) Is Crucial for HENRYs

- 4. 2025 Contribution Limits and Key Rules

- 5. Traditional vs. Roth 401(k): What Works Best for High Earners

- 6. Advanced Tactics: Mega Backdoor Roth and After-Tax Contributions

- 7. Employer Matching: How to Maximize It

- 8. Tax Optimization for HENRYs via 401(k)

- 9. Avoiding Common Mistakes High Earners Make

- 10. Top Tools and Calculators for 401(k) Optimization

- 11. FAQ: Your Top 401(k) Questions Answered

- 12. Related Resources and Next Steps

1. Introduction: Why High Earners Still Feel Broke

You’re a high achiever. You’ve climbed the professional ladder, secured a six-figure income, maybe even cracked $300K or more with your partner. You’ve got the credentials, the job title, and the LinkedIn profile to prove it. But despite all that success – financial peace still feels out of reach.

Welcome to the paradox of being a HENRY: High Earner, Not Rich Yet.

You’re not alone. Over 27 million American households fall into this category – earning well above the national median, yet still stressed about money. According to recent data, 36% of high earners live paycheck to paycheck, and 77% report losing sleep over finances . Not because they’re irresponsible – but because the system wasn’t built for them.

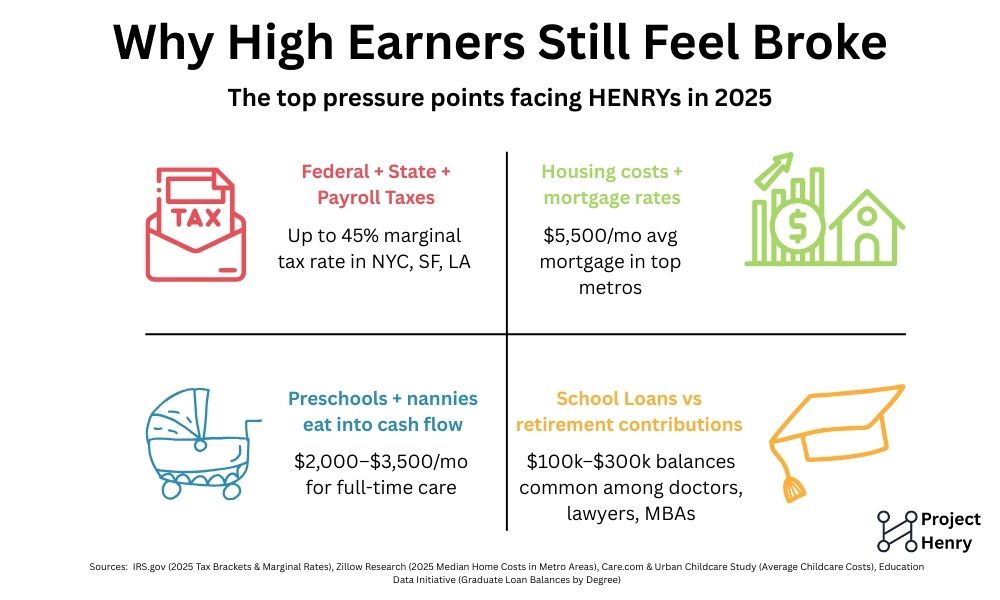

What’s Draining High Incomes?

For HENRYs in high-cost cities like San Francisco, New York, Boston, and Seattle, the income gap between “comfortable” and “wealthy” feels razor-thin. Here’s why:

- Federal & State Taxes: With marginal tax rates of 32% to 37%, plus state income taxes (up to 13.3% in California), a household making $400K could easily lose $150K+ to taxes before they see a dime.

- Childcare Costs: In places like NYC or the Bay Area, full-time daycare for two children can easily exceed $4,000/month – more than many families’ mortgage payments.

- Housing Burden: Mortgage payments on a $1.5M home with property taxes and maintenance? Often $7,000–$10,000/month. And in high-demand school districts, there’s little room for negotiation.

- Student Loans: Doctors, lawyers, and MBAs commonly carry $100K–$300K in educational debt, often refinanced but still looming large.

- Lifestyle Inflation: You’re working long hours in demanding roles. You outsource meals, buy time-saving conveniences, and reward yourself – because time is short and expectations are high.

Despite the income, it doesn’t feel like wealth. And more importantly, it doesn’t act like wealth. Your savings rate might hover around 10–15% – a solid effort, but not enough to retire comfortably at 55, send two kids to private school, and keep the house in Palo Alto.

Why This Guide Matters

Your 401(k) isn’t just a retirement plan – it’s a multi-layered tax shield, wealth-building engine, and risk management tool, all rolled into one. And yet, most high earners use it passively – setting autopilot contributions and moving on.

But you can do better. You have to do better.

This guide is designed for you – the HENRY navigating real-world financial stress despite enviable income. It will help you:

- Maximize 401(k) contributions in 2025 under the latest IRS rules

- Understand the advanced strategies available only to high earners

- Leverage employer matching, Roth conversions, and after-tax contributions

- Avoid costly mistakes that can limit your future flexibility

- Optimize your tax picture without needing to become a CPA

This isn’t fluff. This is a playbook grounded in the real constraints, costs, and opportunities of HENRY life. Whether you’re a dual-income tech couple in Austin, a physician in Boston, or a corporate attorney in L.A., this guide will help you make smarter moves with the dollars you already earn.

Let’s turn your high income into lasting wealth – without adding stress or sacrificing your lifestyle.

2. 401(k) Basics Refresher (With 2025 Updates)

Before we get tactical, it’s worth refreshing the fundamentals of 401(k) plans – especially because small nuances matter more when your income pushes you into the top 5% of earners.

What Is a 401(k)?

A 401(k) is a tax-advantaged retirement plan offered by employers, allowing employees to defer part of their salary into an investment account. Over time, these investments grow either tax-deferred (Traditional 401(k)) or tax-free (Roth 401(k)), depending on the type of contributions made.

For high earners, it serves not just as a retirement account, but as a:

- Tax mitigation strategy

- Wealth compounding vehicle

- Tool for employer compensation maximization

- Backdoor entry into Roth investment accounts

Types of 401(k) Contributions

| Type | Tax Treatment | Withdrawal Tax | Income Limits? |

|---|---|---|---|

| Traditional | Pre-tax | Taxed as ordinary income | No |

| Roth | After-tax | Tax-free (if qualified) | No for 401(k)s (unlike Roth IRAs) |

| After-Tax (Non-Roth) | After-tax | Earnings taxed unless converted | No |

Many HENRYs are unaware that after-tax, non-Roth contributions (not the same as Roth 401(k)) are allowed in certain employer plans and can be converted to Roth via a “Mega Backdoor Roth” strategy – more on that later.

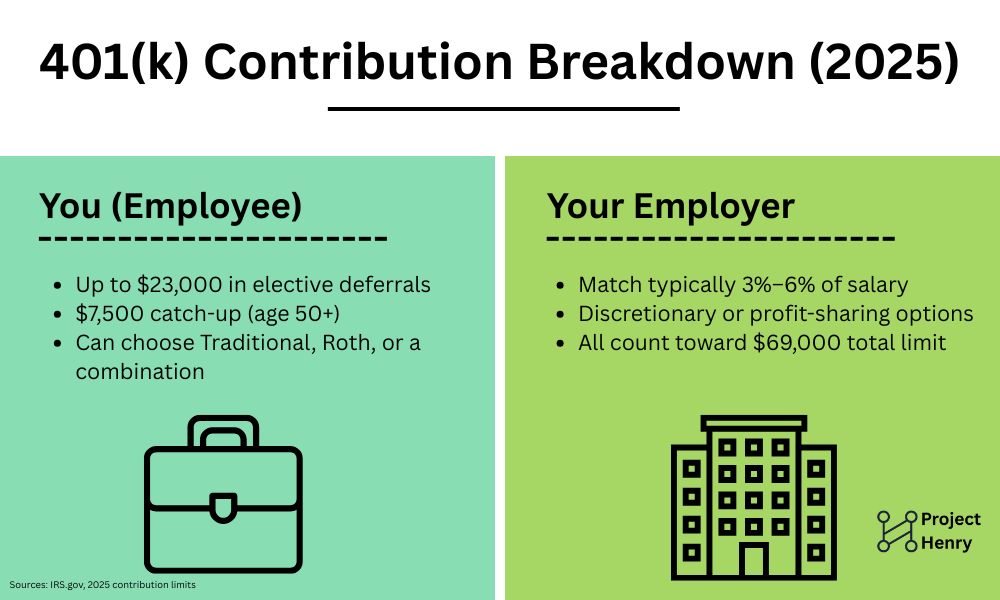

2025 IRS 401(k) Rules and Limits (Updated)

According to the IRS, here are the new limits for 2025:

| Limit Type | 2025 Amount |

|---|---|

| Employee Contribution Limit | $23,000 |

| Catch-Up Contribution (50+) | $7,500 |

| Total Contribution Limit (Employer + Employee) | $69,000 |

| With Catch-Up (50+) | $76,500 |

These totals are per person, so dual-income couples could potentially shield up to $138,000–$153,000 per year in tax-advantaged retirement savings through 401(k)s alone.

Important: Matching contributions from your employer do not count toward the $23,000 employee limit – but they do count toward the $69,000 overall limit.

Download: [401(k) Contribution Limits by Profession & Income Tier (2025)]

When Can You Access the Money?

401(k) plans are designed for retirement, but that doesn’t mean the funds are locked forever. Here’s the general timeline:

- 59½: Eligible to withdraw funds without early withdrawal penalty

- 55 Rule: If you leave your job at 55+, you can access that employer’s plan early

- 72 (or 73): Required Minimum Distributions (RMDs) begin (unless Roth)

Roth 401(k)s are subject to RMDs, but you can avoid them by rolling into a Roth IRA after retirement.

Vesting and Portability

Many HENRYs change employers every 2–5 years, so it’s important to understand:

- Vesting schedules: Employer matches may not fully belong to you immediately. Typical schedules are 3-year cliff or 5-year graded.

- Portability: You can roll over your 401(k) to an IRA or a new employer’s plan to consolidate assets or gain more control over investment options.

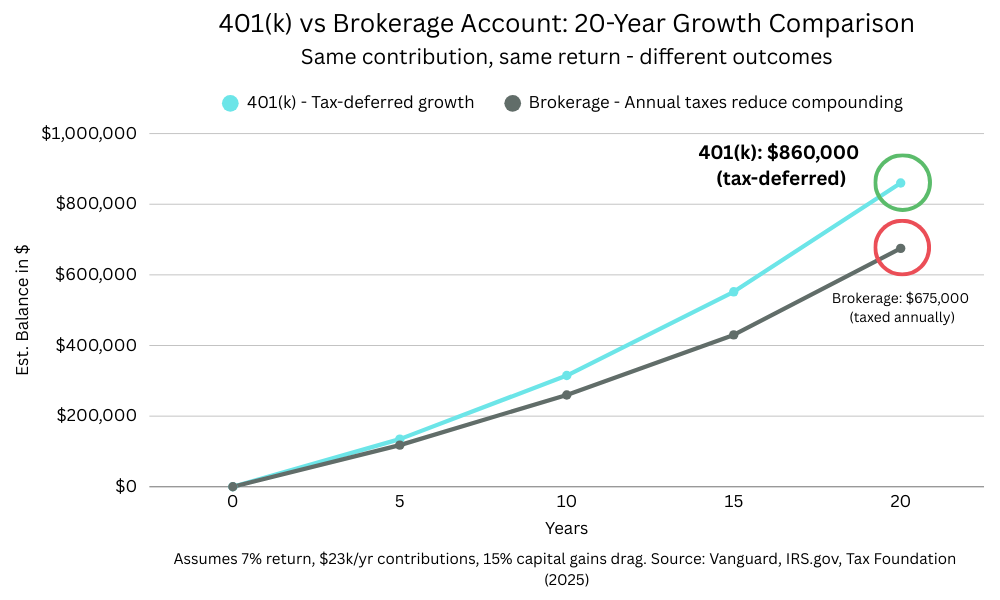

3. Why Maxing Out Your 401(k) Is Crucial for HENRYs

When you’re a high earner juggling taxes, mortgage payments, childcare, and ambitious life goals, your instinct might be to keep cash flexible and investments liquid. That often means under-prioritizing your 401(k). But for HENRYs, this can be a costly mistake.

Maxing out your 401(k) – especially when done strategically – offers some of the highest ROI moves you can make in your financial life. Not because of wild investment returns, but because of what it does to your tax liability, savings automation, and long-term compounding power.

The Tax Advantage Is Front-Loaded

Every dollar you contribute to a Traditional 401(k) reduces your taxable income today. For someone in a 35% federal bracket, contributing the full $23,000 in 2025 could slash over $8,000 off your federal tax bill – before even factoring in state taxes. That’s an immediate, guaranteed “return” you’d be hard-pressed to match elsewhere.

And if your employer offers matching or profit-sharing? That’s free money, which only adds to the value.

Avoiding Lifestyle Creep Through Automation

Let’s be honest: the more you earn, the easier it is to spend more without noticing. The 401(k) helps you fight lifestyle inflation by moving money off the table before it hits your checking account. This creates a built-in saving habit that scales with your income – and works especially well for high earners who often don’t have time to budget manually.

Think of it as a forced savings plan that adapts to your raise – not your spending.

Compounding Is More Valuable the Earlier You Start

Time is the one asset you can’t earn more of. A 35-year-old HENRY who maxes out a 401(k) for just the next 10 years could build a portfolio worth over $1 million by age 55, assuming a modest 6–7% annual return. Waiting even five years can reduce that total by hundreds of thousands – simply due to lost compounding time.

Protection Against Uncertainty

Another overlooked feature: 401(k) assets are protected from creditors in bankruptcy or lawsuits, and may not count against your child’s financial aid application to the same degree as taxable assets. In a profession where lawsuits or income volatility (especially for contractors or doctors) can be real risks, this insulation matters.

You Can’t “Catch Up” Later Without Sacrifice

Some high earners think they’ll contribute more in their 40s or 50s when “things calm down.” But that’s often when college savings, parental care, or health issues ramp up. Delaying 401(k) maximization usually means playing catch-up – and sacrificing flexibility when you need it most.

4. 2025 Contribution Limits and Key Rules

As a high earner, understanding exactly how much you can contribute to your 401(k) and under what conditions is essential to taking full advantage of your plan. In 2025, the IRS offers more room than ever to reduce your taxable income and accelerate your long-term wealth. For an overview of those core IRS limits, including employee deferrals, catch-up contributions, and total caps, see Section 2: 401(k) Basics Refresher.

Instead of rehashing the table, this section focuses on how to interpret those limits in a high-income context and what you need to do to maximize your advantages within them.

What About Income Limits?

There are no income limits that prevent you from contributing to a 401(k), even if you earn $400,000 or more. But your employer’s plan may impose restrictions if you qualify as a Highly Compensated Employee (HCE) under IRS rules.

In 2025, you’re considered an HCE if you:

- Earned $155,000 or more in 2024, or

- Own more than 5 percent of the business

If your company fails non-discrimination testing, your contributions may be limited or partially refunded. Ask your HR department:

- Does our plan use a Safe Harbor structure?

- Are there after-tax contribution options if deferrals are capped?

- Can I access a Mega Backdoor Roth strategy?

How to Maximize Contributions Throughout the Year

If you’re trying to hit the $23,000 employee deferral limit in 2025, divide that by your number of pay periods. For example:

- Biweekly payroll = $884.62 per paycheck

- Monthly payroll = $1,916.67 per month

If your employer offers matching based on each paycheck, front-loading your contributions could mean missing out on match dollars in later months. Confirm whether your plan uses:

- Per-pay-period matching (most common)

- Annual true-up match (reimburses missed match if you front-load)

Understanding your match structure could be worth thousands per year.

Dual-Income Households: Planning Together

For couples earning $250K+ each, coordination is key. You may want to:

- Stagger contributions to avoid cash flow strain

- Use one partner’s plan to access advanced features like after-tax contributions or Mega Backdoor Roth

- Optimize across both plans for total family contributions of up to $138,000 to $153,000 (with catch-up)

Real-World Examples for High Earners

| Profession | Salary | Employer Match | Est. Total 401(k) Contribution |

|---|---|---|---|

| Tech Manager (SF) | $190,000 | 6% | $34,400 |

| Big Law Associate (NYC) | $215,000 | 4% | $31,600 |

| Dual Physicians (Boston) | $500,000 | 5% each | $138,000 combined |

This assumes full $23,000 employee contributions and match or profit-sharing. In some plans, profit-sharing alone may add $10,000 to $20,000 per year.

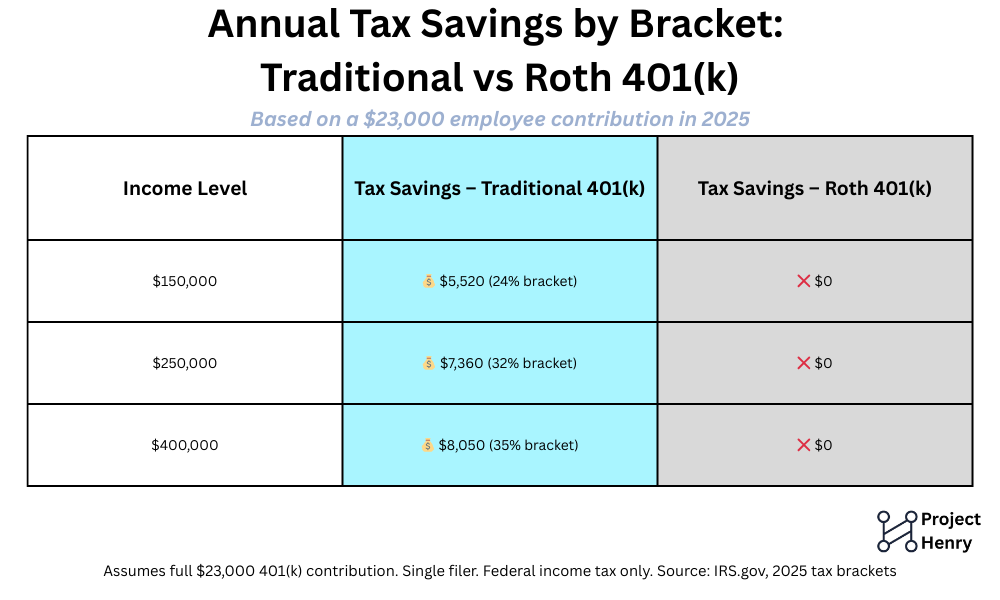

5. Traditional vs. Roth 401(k): What Works Best for High Earners

One of the most important but misunderstood choices high earners face is how to split contributions between Traditional and Roth 401(k) accounts. The difference isn’t just about taxes today versus taxes later. It’s about flexibility, control, and optimizing for your lifetime effective tax rate – something most HENRYs rarely calculate.

The right decision depends on your current income, expected future tax bracket, location, and even your retirement goals. But for high earners in 2025, there are clear trends and tradeoffs worth understanding.

Understanding the Basics

- Traditional 401(k): Contributions are made with pre-tax dollars. You lower your taxable income now and pay ordinary income tax on withdrawals later.

- Roth 401(k): Contributions are made with after-tax dollars. You pay taxes today, but qualified withdrawals in retirement are completely tax-free.

Both grow tax-deferred. And unlike Roth IRAs, Roth 401(k)s have no income limits, making them accessible to every HENRY.

When Traditional 401(k) Typically Makes Sense

If you’re currently in a high marginal tax bracket – usually 32 percent or above – Traditional contributions are often the most efficient way to reduce your tax liability in the present.

For example, a single tech consultant earning $280,000 in California could save over $9,000 in combined federal and state taxes just by maxing out a $23,000 Traditional 401(k) contribution.

Traditional accounts also work well if:

- You plan to retire in a lower-cost state

- You expect lower income in retirement

- You need every dollar of current cash flow optimized

When Roth 401(k) Deserves a Closer Look

While Traditional accounts reduce taxes now, Roth 401(k)s protect you from future tax hikes and create tax-free retirement income, which is powerful when you’re trying to build flexibility.

Roth 401(k)s are especially useful if:

- You’re in the early stages of a high-income career and expect your earnings to rise

- You’re in a lower tax state today but may retire in a high-tax state (like CA, NY, or MA)

- You’re pursuing early retirement or FIRE strategies and want to minimize future required distributions

Important: Roth 401(k)s are subject to RMDs starting at age 73 – unless rolled into a Roth IRA later.

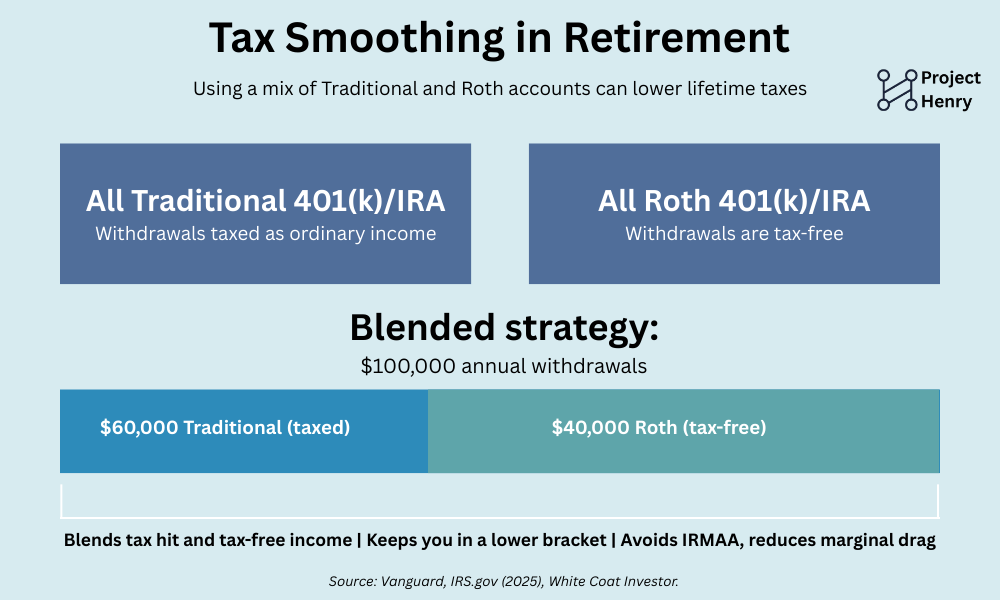

Blending Both for Tax Diversification

Many HENRYs benefit from a split approach – for example, allocating 70 percent to Traditional and 30 percent to Roth. This gives you both immediate tax savings and long-term tax flexibility.

In uncertain tax environments, tax diversification is often smarter than trying to predict exact rates. A balanced mix allows future withdrawal strategies to be tailored based on market returns, income needs, or changes in the tax code.

What About Mega Backdoor Roth?

For those whose employers support after-tax contributions and in-plan conversions, the Mega Backdoor Roth offers an opportunity to push even more money into Roth accounts – often up to an additional $30,000 or more each year, completely separate from the standard $23,000 limit.

We’ll break this down fully in the next section, but here’s the key: you can use both Traditional and Roth 401(k) contributions and still take advantage of Mega Backdoor Roth strategies if your plan allows it.

Quick Comparison Summary

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Contributions | Pre-tax | After-tax |

| Taxes Now | Deferred | Paid now |

| Withdrawals | Taxed as ordinary income | Tax-free if qualified |

| Required Minimum Distributions (RMDs) | Yes | Yes (can avoid by rolling to Roth IRA) |

| Income Limits | None | None |

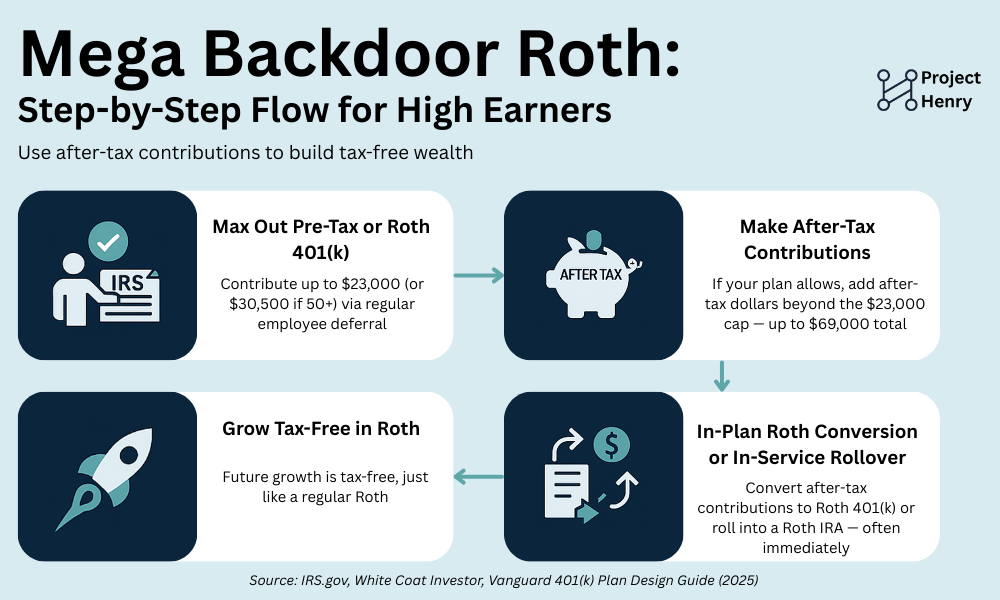

6. Advanced Tactics: Mega Backdoor Roth and After-Tax Contributions

If you’re already maxing out your 401(k) and looking for ways to further accelerate tax-advantaged savings, the Mega Backdoor Roth strategy is a powerful but often overlooked tool – especially for high earners with limited access to Roth IRAs.

Many HENRYs are surprised to learn they can contribute tens of thousands beyond the standard $23,000 limit – and convert that money into Roth status. But this only works if your employer offers the right plan features.

Let’s break it down.

What Is the Mega Backdoor Roth?

This strategy allows you to:

- Contribute after-tax dollars to your 401(k) – above the regular pre-tax or Roth limits.

- Immediately convert those after-tax contributions to a Roth 401(k) or Roth IRA.

If your employer plan supports both after-tax contributions and in-plan conversions (or in-service rollovers), you could contribute up to $46,000 more in 2025 on top of the $23,000 regular deferral.

Combined with employer match, this lets you hit the $69,000 total annual limit.

2025 Contribution Math: A Real-World Example

Say you’re earning $250,000 and your employer contributes $10,000 in matching. That leaves $36,000 of unused space under the IRS’s $69,000 cap.

If your plan allows it, you can:

- Make $36,000 in after-tax contributions

- Then convert those into a Roth 401(k) or roll into a Roth IRA

- Result: $36,000 of additional Roth space, growing tax-free forever

This is one of the only legal ways for high earners to build Roth wealth after hitting income limits for Roth IRAs.

What You Need in Your Plan

Ask your HR or plan administrator the following:

- Does the plan allow after-tax contributions beyond regular deferrals?

- Does it support in-plan Roth conversions?

- Does it allow in-service rollovers to a Roth IRA?

- Is there a cap on how much after-tax you can contribute?

If the answer is yes to most or all, you’re a candidate for the Mega Backdoor Roth.

Common Pitfalls to Avoid

- Not converting immediately: If after-tax funds are left to grow before conversion, you’ll owe taxes on the gains.

- Assuming your plan allows it: Many plans don’t support this, or limit the frequency of conversions.

- Cash flow strain: Contributing above $23,000 requires careful budgeting – especially in high-cost cities.

Who Should Use This Strategy?

The Mega Backdoor Roth is ideal for HENRYs who:

- Are already maxing out the standard $23,000

- Have extra cash flow after meeting other goals (emergency fund, student loans, etc.)

- Want to build long-term tax-free income for early retirement or high-cost later years

Even if you’re unsure now, knowing your plan’s rules lets you pivot later when your cash flow allows.

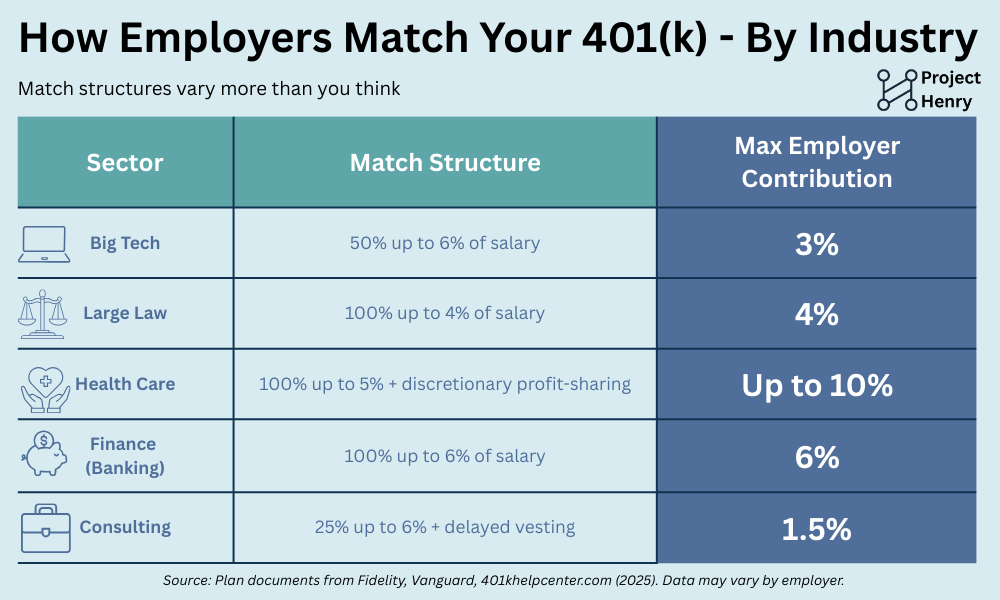

7. Employer Matching: How to Maximize It

When you’re earning $150,000 to $400,000 or more, it’s tempting to overlook a few thousand here or there. But your employer’s 401(k) match isn’t just a benefit – it’s part of your total compensation. Leaving match dollars on the table is like walking away from a raise.

Yet many HENRYs accidentally do just that.

The value of the match often hides in plain sight. It may be tied to per-pay-period contributions, require vesting, or be capped at a percentage you didn’t realize. And because HENRYs often front-load their contributions early in the year for tax reasons, they may unintentionally miss out on matching dollars in the process.

Understanding the Most Common Match Structures

The most common formula is 100 percent match on the first 3 percent of your salary, plus 50 percent on the next 2 percent – totaling a 4 percent effective match. On a $200,000 salary, that’s $8,000 annually.

But formulas vary by employer. Some match up to 6 percent. Others offer flat contributions regardless of participation. And some delay matching until the end of the year, particularly in bonus-heavy industries like finance and law.

Why Timing Your Contributions Matters

Let’s say you front-load your 401(k) and hit the $23,000 limit by August. If your employer matches each paycheck based on that pay period’s deferral, you could forfeit thousands of dollars by contributing too aggressively, too soon.

This is especially true if your plan does not offer a “true-up” – an end-of-year adjustment to ensure you receive the full eligible match, regardless of how your contributions were timed.

To avoid this, review your plan documents or ask HR.

Vesting and Eligibility Rules

Even if you receive employer match contributions, they may not fully belong to you right away. Some plans use a vesting schedule, typically between two and six years, especially in private companies or smaller firms.

If you’re considering a job change, knowing your vesting status could affect your timing. Leaving before you’re fully vested may cost you thousands in forfeited contributions.

For example, if your employer uses a six-year graded vesting schedule and you depart after year four, you might only retain 60 percent of their contributions. The rest goes back to the plan.

8. Tax Optimization for HENRYs via 401(k)

For HENRYs, tax planning isn’t a side project – it’s essential. When you’re paying 35 to 50 percent of your income to federal, state, and local taxes, small strategic moves can lead to meaningful gains.

The 401(k) isn’t just a retirement savings vehicle. It’s a tax-deferral machine – and when used properly, it can help you reduce taxable income now, smooth your lifetime tax rate, and create flexibility in the future.

Lowering Today’s Taxable Income

Let’s start with the most straightforward benefit. Contributing to a Traditional 401(k) reduces your adjusted gross income (AGI). For a single filer earning $250,000 in 2025, the full $23,000 contribution could reduce federal taxes by over $8,000 – even more if you live in a high-tax state like California or New York.

If you’re a dual-income household and both partners contribute the max, you could reduce your joint taxable income by $46,000, potentially dropping into a lower marginal tax bracket. That alone can unlock additional deductions and credits.

For those subject to AMT (Alternative Minimum Tax), reducing AGI via 401(k) contributions can be one of the only remaining levers available.

Managing Future Tax Exposure

While pre-tax deferrals help today, they create a tax obligation down the road. Withdrawals from a Traditional 401(k) are taxed as ordinary income – and required minimum distributions (RMDs) start at age 73.

This is where tax diversification becomes powerful. Contributing to both Traditional and Roth accounts gives you control in retirement. You can decide which account to pull from based on your tax situation in a given year – minimizing taxable Social Security, reducing Medicare IRMAA surcharges, or staying below thresholds for capital gains.

Leveraging Deductions in Peak Years

If you receive a large bonus, RSUs vest, or you sell equity in your company, that spike in income can push you into a top bracket quickly. One of the fastest ways to blunt the impact is maxing out your 401(k) before the end of the year.

Some employers also allow bonus deferrals directly into your 401(k) plan. These must be elected in advance, so check with HR before Q4 rolls around.

Don’t Forget State-Level Savings

In high-tax states, every dollar of pre-tax deferral can save you an additional 6 to 13 percent. For HENRYs in California, that means a $23,000 Traditional 401(k) contribution could save around $11,000 when combined federal and state taxes are considered.

If you plan to retire in a lower- or no-tax state like Florida or Texas, you’re effectively arbitraging state tax brackets – deducting in a high-tax state and withdrawing in a low-tax one.

9. Avoiding Common Mistakes High Earners Make

Earning a high income gives you more tools – but also more traps. Many HENRYs assume that income alone will secure their financial future, but real wealth comes from strategic decisions. Unfortunately, even savvy professionals fall into common 401(k)-related pitfalls that can cost tens or even hundreds of thousands over time.

Let’s walk through the top errors and how to sidestep them.

Front-Loading Without Understanding Match Structure

A popular strategy among high earners is to max out 401(k) contributions early in the year. But if your employer matches per paycheck – and doesn’t offer a year-end true-up – front-loading can backfire. You might miss out on months of eligible match contributions.

The fix: find out exactly how your employer calculates and applies the match. If necessary, spread your contributions evenly throughout the year or adjust based on your plan’s policy.

Ignoring the Mega Backdoor Roth Option

Many professionals don’t realize their employer offers after-tax contributions with in-plan conversions – the building blocks of the Mega Backdoor Roth. If you’re already maxing out the standard $23,000 and still have cash flow available, this could be one of the most tax-efficient moves available to you.

Ask HR for a summary plan description and scan for language around “after-tax contributions,” “in-service withdrawals,” or “in-plan Roth conversions.”

Underestimating Roth Value in Early or Low-Tax Years

It’s easy to default to Traditional contributions – especially when chasing deductions. But for early-career HENRYs, or years when income is temporarily lower (e.g., job transition, parental leave, business losses), those may be the best times to favor Roth contributions instead.

The goal is to pay taxes when they’re cheapest – not just delay them forever.

Missing Vesting Milestones

This mistake is more common than you’d think. Professionals planning a job move or sabbatical sometimes leave without realizing they’re only one year away from full vesting on employer contributions. That could mean walking away from $10,000 to $50,000 – or more.

Review your employer’s vesting schedule and factor that into your timeline before giving notice.

Failing to Reassess Annually

Your 401(k) strategy should evolve with your income, tax bracket, family situation, and retirement goals. Yet many HENRYs set their deferral percentage once and never adjust. Others forget to rebalance their investments or check on contribution pace.

Set a recurring calendar reminder each December and again mid-year to reassess your plan settings and goals.

10. Top Tools and Calculators for 401(k) Optimization

When you’re juggling a demanding career, family responsibilities, and financial goals, the right tools can turn confusion into clarity. For HENRYs, especially those navigating six-figure incomes and complex benefits packages, these calculators and resources aren’t just nice-to-haves – they’re essential.

Here are the most valuable tools to help you maximize your 401(k) strategy in 2025 and beyond.

1. Contribution Forecasting Tool

This calculator helps you estimate how much you need to contribute per paycheck to reach the IRS limit by year-end – while accounting for employer match, catch-up contributions (if eligible), and any bonus income.

Recommended Tool: SmartAsset’s 401(k) Contribution Calculator

Best For: Planning biweekly or monthly contribution amount

2. Traditional vs. Roth Analyzer

One of the most misunderstood decisions for high earners is how to split between Traditional and Roth. This tool models your future tax rates, expected income, and withdrawal strategies to help you make a better-informed decision.

Recommended Tool: NerdWallet’s Roth vs Traditional 401(k) Calculator

Best For: Tax diversification planning and scenario modeling

3. Mega Backdoor Roth Planner

This advanced tool models your eligibility and potential savings if your employer allows after-tax contributions and in-plan conversions. It’s ideal for HENRYs earning above $250K and looking for additional tax-advantaged space.

Recommended Tool: Personal finance spreadsheets (custom template recommended)

Best For: Mapping contribution flow and timing based on employer plan features

4. Match Maximization Worksheet

This worksheet isn’t a calculator, but a tool for reviewing your employer match structure, identifying gaps, and timing contributions to capture every available dollar.

Recommended Approach: Build your own using HR documents or use our downloadable template

Best For: Avoiding front-load penalties and missed match opportunities

5. Future Value of 401(k) Estimator

Visualizing how your current contributions will grow over time can reinforce good behavior. This tool models future portfolio size based on your current age, expected returns, and contribution strategy.

Recommended Tool: Vanguard’s Retirement Nest Egg Calculator

Best For: Long-term motivation and scenario testing

Bonus: Platform-Specific Dashboards

If your 401(k) is managed through Fidelity, Empower, or Vanguard, use their built-in dashboards. Many now include:

- Real-time contribution tracking

- Fee transparency

- Retirement readiness metrics

Logging in quarterly to review these can help you spot missed contributions or inefficient fund allocations early.

11. FAQ: Your Top 401(k) Questions Answered

Even for financially savvy professionals, 401(k) rules can be dense, contradictory, or just plain confusing. Below are the questions HENRYs ask most often – along with clear, actionable answers for 2025.

12. Related Resources and Next Steps

Maximizing your 401(k) as a high earner isn’t just about hitting a number – it’s about building flexibility, minimizing tax drag, and future-proofing your lifestyle. But you don’t have to do it all at once. Use this guide as your launchpad, and build momentum with the tools and resources below. Don’t forget to also consider income diversification strategies to ensure a greater streams of income that can improve your overall financial success.

Suggested Next Reads

- How to Maximize Your HSA as a High Earner A stealth retirement strategy for those with high-deductible health plans.

- Living in NYC on $250K: Budget Breakdown for Dual-Income HENRYs Real numbers, real tradeoffs, and how to make your six-figure income go further.

- Mega Backdoor Roth 2025 Guide Deep dive into rules, execution tips, and conversion workflows with plan checklists.

- The HENRY Guide to Early Retirement (FIRE 2.0) How high earners can build optionality without compromising current lifestyle.

Join Our Insider Community

📩 Subscribe to the HENRY Insider Weekly

Get advanced strategies, tax updates, city-specific guides, and wealth-building checklists sent straight to your inbox.

Download All Planning Resources

📥 Download the Complete 401(k) Optimization Bundle

Includes every worksheet, calculator link, and planner mentioned in this guide – all in one place.

Coming soon!