🔥 Section 1: Introduction: Why FIRE Feels Out of Reach for HENRYs

FIRE, or Financial Independence, Retire Early, offers a compelling path to freedom. But for many high earners, the idea can feel distant or even unrealistic.

You may earn a high income, yet still feel like you’re barely building lasting wealth. You contribute to your retirement accounts, pay your mortgage, cover childcare, and try to enjoy life along the way. Still, there’s a constant tension between income and financial progress. If you fall into the HENRY category – that is, high earner, not yet rich – you are not alone.

This guide is for professionals in that position. You are likely between 28 and 45, earning $150,000 or more, and living in a high-cost metro or suburb. You may be part of a dual-income household, managing demanding careers while raising a family. You’re doing a lot right, but it still feels like something is missing.

- 🔥 Section 1: Introduction: Why FIRE Feels Out of Reach for HENRYs

- 🔥 Section 2: What Is FIRE and Why It Matters for HENRYs

- 🔥 Section 3: Define Your HENRY FIRE Number (With Realistic Assumptions)

- 🔥 Section 4: Assess Your Current Financial Baseline

- 🔥 Section 5: Slash Lifestyle Creep Without Sacrificing Joy

- 🔥 Section 6: Maximize Savings Rate Without Burning Out

- 🔥 Section 7: Optimize Income Streams (Primary, Secondary, Passive)

- 🔥 Section 8: Choose the Right Investment Strategy

- 🔥 Section 9: Understand the Tax Code and Use It to Your Advantage

- 🔥 Section 10: Plan for Children, College, and Elder Care

- 🔥 Section 11: Use Location Arbitrage to Reach FIRE Faster

- 🔥 Section 12: Create a Withdrawal and Bridge Strategy

- 🔥 Section 13: FAQ – FIRE Questions for HENRYs

Why FIRE Feels So Far Away

Even with a strong salary, the path to financial independence is full of roadblocks. Many are beyond your control:

- The cost of living in cities like New York, San Francisco, or Boston outpaces wage growth year after year.

- Lifestyle creep gradually increases spending. Better housing, childcare, and convenience services start to feel essential.

- Student loans from graduate or professional degrees may still be significant.

- Childcare and education costs often rival mortgage payments.

- High tax brackets eat a large portion of your income, while deductions and credits phase out.

- Time constraints limit your ability to research and optimize your finances.

This isn’t about overspending. It’s the reality of living a high-responsibility life in a high-expense environment. FIRE may feel out of reach because most content about it is designed for people with drastically different lives.

Why This Guide Is Different

Most FIRE strategies are written for single, frugal, remote workers living in low-cost areas. They’re not designed for dual-income professionals managing school runs, aging parents, and expensive housing.

This guide is built for you. It presents a practical, detailed roadmap to help high earners make smart financial decisions, build wealth faster, and move toward financial independence on realistic terms.

You’ll learn how to:

- Calculate a FIRE number that reflects your true cost of living

- Maximize your savings without sacrificing your lifestyle

- Use tax-efficient strategies that are underused at higher income levels

- Build a sustainable investment plan

- Create a bridge strategy to access funds before traditional retirement age

FIRE doesn’t have to mean quitting your job at 40. It can simply mean having choices. Whether you want to downshift careers, take a sabbatical, or retire early, this guide will help you get there.

Now let’s define what FIRE really means for high earners, and why it matters more than ever.

🔥 Section 2: What Is FIRE and Why It Matters for HENRYs

FIRE, or Financial Independence, Retire Early, offers a compelling escape from financial stress. It’s not about quitting work forever. It’s about reaching a point where your investments can support your lifestyle, and you can choose how you spend your time.

For high earners, FIRE is both appealing and challenging. You’re bringing in strong income, yet rising costs, family obligations, and tax pressure make it feel like you’re barely moving forward. FIRE offers an alternative path, one that gives you control, flexibility, and peace of mind.

What FIRE Actually Means

FIRE isn’t a one-size-fits-all concept. There are several versions:

Fat FIRE: Achieving financial independence with a high-cost lifestyle, typically $100,000 to $200,000 in annual expenses. This is the most realistic version for HENRYs.

Barista FIRE: Partial independence where part-time or lower-stress work covers essentials while your investments grow. Often used to bridge healthcare or lifestyle gaps.

Lean FIRE: Retiring on a tight budget. Generally not suitable for high earners with families.

Coast FIRE: Saving aggressively early so your investments can grow without further contributions, letting you coast into full independence.

For most HENRYs, Fat FIRE or Barista FIRE are the most aligned options. These approaches allow you to maintain your quality of life without relying on a full-time salary.

Why FIRE Feels Different for HENRYs

HENRYs have different constraints compared to typical FIRE followers. You’re not living on $40,000 per year. You might live in an expensive city. You’re managing kids, aging parents, and careers. You’re also in a high tax bracket, so efficiency is everything.

Here are the key challenges:

- Your expenses are already optimized in many ways, leaving little room to cut.

- Cost of living is higher in the cities where your career thrives.

- Student debt and childcare costs add significant monthly pressure.

- Time is scarce. You don’t have hours to spend tracking every transaction or reading obscure tax blogs.

- Most FIRE advice doesn’t speak to your situation.

That’s why a tailored strategy is essential. Your path needs to be smarter, not harder.

FIRE Isn’t About Quitting – It’s About Freedom

FIRE is not just for people who want to quit forever. It’s for people who want options.

For example, FIRE can help you:

- Take a six-month sabbatical

- Change careers without worrying about the salary drop

- Work part-time or start your own business

- Travel more and work less

- Stop worrying about money

It’s about designing a lifestyle that aligns with your values instead of reacting to financial stress.

Key Takeaways

- FIRE is not about extreme frugality. It’s about financial choice and control.

- Fat and Barista FIRE are realistic options for high earners with complex lives.

- A smart, tailored plan makes FIRE achievable without compromising your lifestyle.

🔥 Section 3: Define Your HENRY FIRE Number (With Realistic Assumptions)

Your FIRE number is the foundation of your entire plan. It tells you how much you need to accumulate in order to live off your investments. But for HENRYs, this number needs to reflect a higher cost of living, more complex obligations, and a longer retirement horizon.

If you guess low or use someone else’s formula, you risk falling short. If you guess high, you might delay freedom unnecessarily. Getting this number right means starting with realistic, personal assumptions.

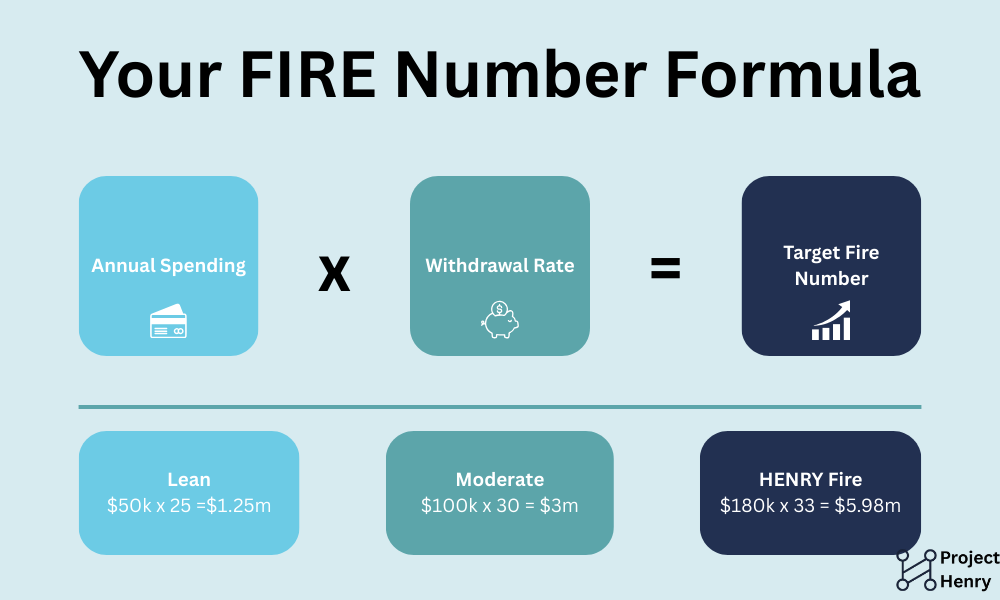

What Is a FIRE Number?

Your FIRE number is the total amount of investable assets you need to generate enough passive income to cover your annual expenses indefinitely.

Basic formula:

FIRE number = Annual expenses × 25 to 33The multiplier you use depends on how conservative you want to be. The traditional 4 percent rule uses a factor of 25. If you want extra safety or plan to retire early, 30 to 33 is more prudent.

Example:

If your household expenses are $180,000 per year, your FIRE number would range from:

- $4.5 million (180,000 × 25)

- $5.9 million (180,000 × 33)

Adjusting for a HENRY Lifestyle

Your actual number will likely need to include:

- Housing in a high-cost metro (or a plan to relocate)

- Private school tuition or large education savings

- Healthcare premiums pre-Medicare

- Annual travel and lifestyle spending

- Elder care or support for aging parents

- Inflation protection over a long retirement period

Take the time to list every major category and assign a monthly or annual cost. Use your real numbers, not national averages. Then multiply your adjusted annual spending by your chosen withdrawal rate (3 to 4 percent).

Tips for Accuracy

- Use post-tax expenses. FIRE is about what you spend, not what you earn.

- Include future costs like college, healthcare, or relocations.

- Don’t forget irregular expenses such as property taxes, travel, or home repairs.

- Plan for inflation by assuming a 2.5 to 3 percent rise in costs per year.

Key Takeaways

- Your FIRE number is the single most important target to define early.

- Use actual spending and a conservative withdrawal rate to reduce risk.

- Customize your calculation to fit your lifestyle, not someone else’s.

- Revisit this number annually or after major life changes.

Coming up next, we’ll evaluate where you currently stand so you can map out how far you need to go.

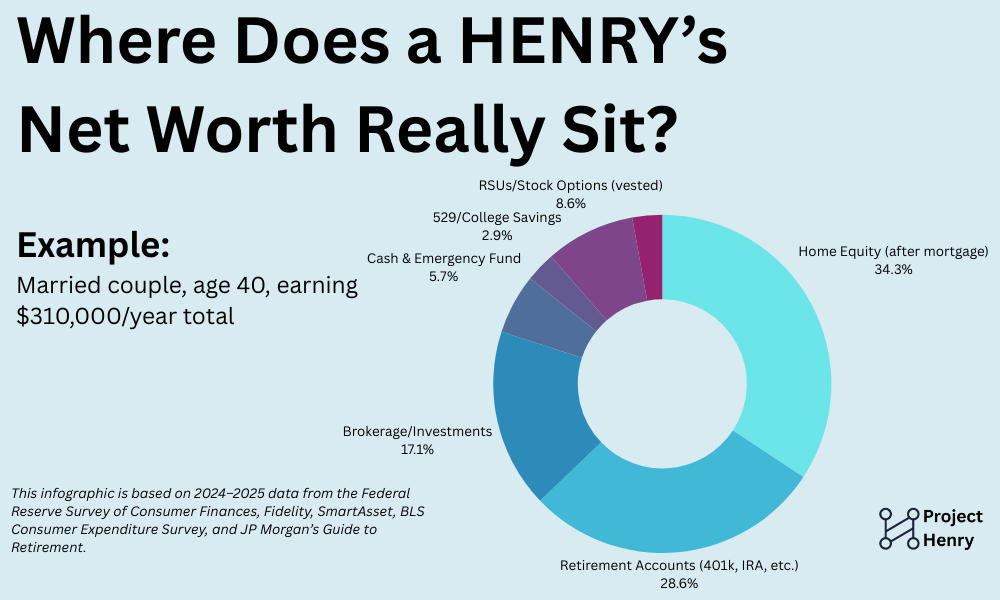

🔥 Section 4: Assess Your Current Financial Baseline

You can’t plan for a HENRY FIRE unless you know where you’re starting from. For high earners, that baseline isn’t just your salary or 401(k) balance. You need a full understanding of your assets, liabilities, savings rate, income sources, and spending habits.

Many HENRYs have more complex finances than the average household. Between joint income, employer stock, student loans, multiple retirement accounts, and rising family expenses, it’s easy to feel financially successful but disconnected from the bigger picture.

This section is about closing that gap. Once you know exactly where you stand, you can chart a realistic path forward.

Track Your Net Worth

Net worth is the foundation of your financial strategy. Calculate it by subtracting all debts from the value of everything you own. Include cash, retirement accounts, brokerage assets, home equity, and any other investments. Subtract student loans, mortgages, credit card debt, and any other liabilities.

This should be reviewed at least quarterly. Use real numbers from statements. Don’t rely on estimates. And don’t include anything you wouldn’t realistically sell or access if needed.

Separate Liquid and Illiquid Assets

Knowing your net worth isn’t enough. You also need to know how accessible it is. FIRE depends heavily on being able to draw income before traditional retirement age.

Classify your assets into:

- Liquid: cash and taxable investments

- Semi-liquid: Roth contributions, vested stock

- Illiquid: home equity, retirement accounts with penalties

This clarity will help you plan your bridge strategy and avoid overestimating what you can use in the near term.

Measure Your Savings Rate

Your savings rate has a bigger impact on FIRE than your income. A high salary means little if most of it is spent.

Calculate your after-tax savings rate based on actual cash saved and invested each year. Include contributions to retirement accounts, brokerage, and other long-term assets you control. Exclude employer matches or paper gains.

Most HENRYs should aim for at least 30 to 40 percent. If you can push to 50 percent or more without serious lifestyle damage, FIRE becomes much more attainable.

Analyze Your Monthly Burn Rate

You need to know how much it costs to live your current life. That number feeds directly into your FIRE calculations. Review three to six months of spending to find an accurate monthly average.

Include everything: fixed costs like mortgage or rent, plus variable spending like groceries, childcare, travel, insurance, and subscriptions. Look for categories that are growing over time or seem out of sync with your values.

This data often reveals how much room you have to adjust without making drastic cuts.

Understand Your Income Sources

Many HENRYs have income beyond a base salary. List every source, including bonuses, stock compensation, rental income, side businesses, and spousal income if you share finances.

Track both total income and the reliability of each stream. This helps you understand risk, identify overdependence, and find opportunities to diversify.

Key Takeaways

- A clear financial baseline is the first step toward FIRE

- Track your net worth using real numbers, not assumptions

- Categorize assets by liquidity to know what’s usable now versus later

- Calculate your true savings rate and update it regularly

- Know your monthly burn rate and your income mix to plan with accuracy

Next, we’ll look at how to reduce lifestyle creep and free up more income without compromising your quality of life.

🔥 Section 5: Slash Lifestyle Creep Without Sacrificing Joy

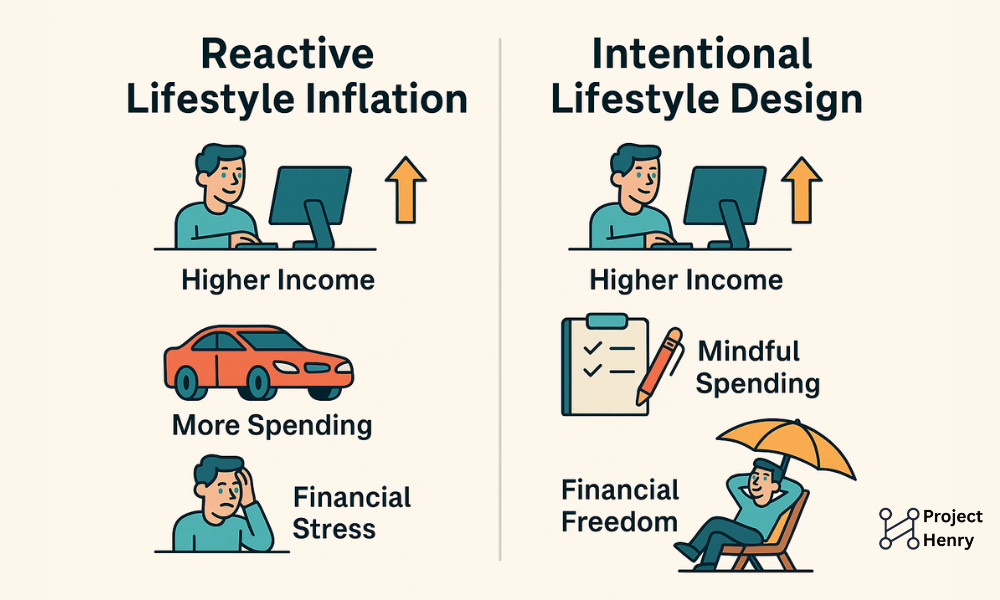

As a high earner, you’re not overspending on impulse. You’re upgrading for convenience, safety, time, and comfort. But when income grows, expenses often rise alongside it – not because of carelessness, but because each individual choice feels justified.

That’s lifestyle creep. It’s not about one splurge, but a slow recalibration of what feels normal. Left unchecked, it silently delays your path to financial independence.

A HENRY FIRE doesn’t require you to live frugally. It does require you to spend with intention. This section is about creating space in your financial life without cutting the things that matter most.

Understanding the Psychology of Creep

For many HENRYs, lifestyle creep is tied to progress. You’ve worked hard to reach this point, and there’s a sense that your life should reflect that. You upgrade the car because it’s safer or more comfortable. You switch to private school because public options feel inadequate. You outsource tasks to preserve your time.

Individually, these choices make sense. But collectively, they can consume every dollar of your raise – and then some. What’s dangerous isn’t the spending. It’s how invisible the change becomes.

Most financial advice targets frivolous consumption. But HENRY spending is often practical. That’s why it requires a different strategy: not guilt, but alignment.

Ask yourself: Does this spending move me closer to the life I want? Or is it filling space I haven’t defined yet?

Redefining What Feels “Normal”

If your lifestyle scales with every income jump, financial independence will always stay ahead of you. The solution isn’t deprivation. It’s designing a lifestyle that’s satisfying enough to stick.

This means making fewer upgrades automatic. Instead of assuming the next pay bump should support a larger home or newer car, pause and consider how else that money could be used. Could it bring more freedom? Could it reduce stress, or open the door to early career shifts?

Many high earners lock themselves into lifestyles that become hard to unwind. Rather than viewing spending as a reward, shift your mindset to see freedom as the ultimate upgrade.

This is especially powerful when applied to big-ticket decisions. Holding onto a reliable car for a few more years or staying in a home that’s “good enough” for longer can unlock tens of thousands per year – money that can work for you instead of disappearing into maintenance, interest, or taxes.

Focus on High-Impact Trade-Offs

Not all categories matter equally. The biggest opportunity for most HENRYs lies in three areas: housing, childcare, and recurring commitments.

Housing is often the most emotionally charged. It’s tied to family, safety, and identity. But small changes – like refinancing, eliminating PMI, or delaying a move – can generate large savings with little real lifestyle impact.

Childcare decisions also deserve scrutiny. There’s often pressure to pursue premium options, but comparing long-term costs versus actual educational outcomes may reveal lower-cost alternatives that align with your values.

And then there are the hidden drains: subscriptions, memberships, delivery fees, small outsourcing conveniences. These costs accumulate not because they’re harmful on their own, but because they become invisible. Conduct a quarterly “expense cleanse” and evaluate what you no longer use or value.

Preserving Joy While Building Efficiency

Cutting lifestyle creep doesn’t mean cutting joy. The goal is to eliminate default upgrades that don’t actually increase life satisfaction. High-quality spending should remain. In fact, it should be protected.

Focus your budget on the things you value most – meaningful experiences, quality time with family, professional growth, or health. These are the investments that create emotional return, not just financial return.

Many HENRYs find that a more intentional lifestyle actually feels richer. Less time chasing upgrades. More space to enjoy what they already have.

Key Takeaways

Lifestyle creep is not a moral failure. It’s a predictable pattern that must be managed with awareness and intent. For high earners, the danger lies in how easy it is to overextend without realizing it. By building systems to pause, reassess, and redirect, you can reclaim large amounts of financial margin without compromising what matters most.

A satisfying life doesn’t have to expand every time your paycheck does. Sometimes, it just needs to be better aligned.

🔥 Section 6: Maximize Savings Rate Without Burning Out

There’s a common misconception that high earners are naturally high savers. In reality, many HENRYs fall into a financial middle ground – they make too much to feel broke, but not enough to feel secure.

If that’s you, the missing piece is often savings rate. You’re not wasting money. You’re simply spending it on a full life. But FIRE requires a different kind of focus. You don’t need to cut aggressively. You need to capture and redirect income before it disappears into your lifestyle.

This is where compounding accelerates. When you boost your savings rate, you shorten the distance to financial independence exponentially.

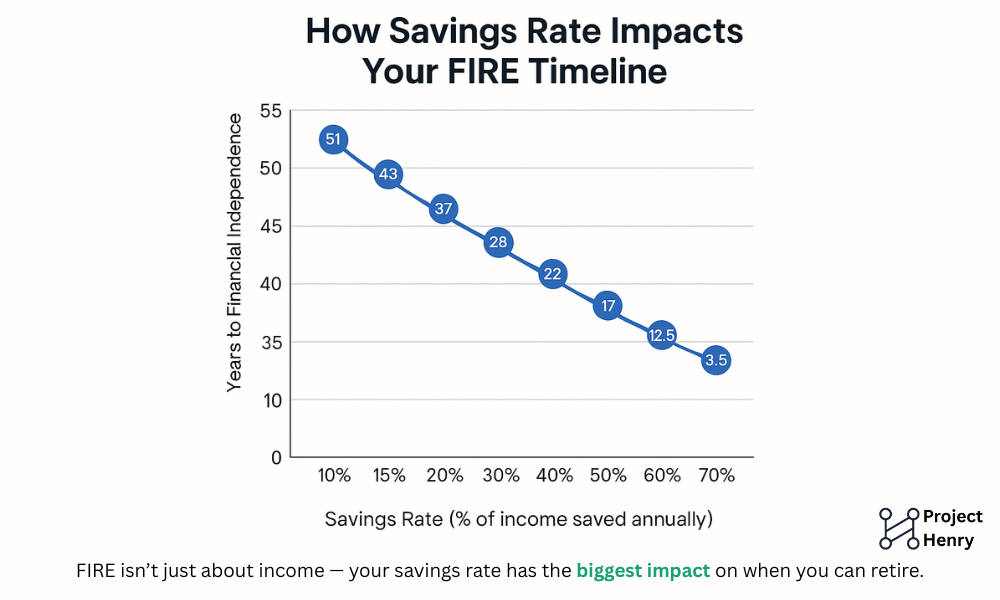

Why Savings Rate Matters More Than Income

Your income helps, but it’s your savings rate that determines your FIRE timeline. Two people earning $250,000 can have drastically different outcomes depending on how much they keep.

A HENRY household saving 20 percent may need 25 years to reach independence. At 50 percent, that number drops to 15 or even 10 years. The math is that powerful.

For high earners, the real advantage isn’t just earning more. It’s being able to save more without impacting quality of life – if the process is intentional.

Make Saving Automatic, Not Aspirational

HENRYs are busy. If you rely on leftover money at the end of the month, it will never be consistent. The solution is to reverse your process. Pay yourself first.

Every time your income increases – whether through a raise, bonus, or tax refund – treat a percentage as non-negotiable savings. Automate transfers to investment accounts before funds hit your checking account. Use fixed contribution rules, not mood-based decisions.

This creates a self-reinforcing loop. As your income grows, so does your FIRE momentum, with no extra decision fatigue.

Avoid Burnout with Tiered Targets

Saving half your income sounds good on paper, but it’s rarely sustainable unless you design a plan that works with your lifestyle.

Use tiered benchmarks. Start at 25 percent and build in layers. Each increase should be supported by either a new income stream or a reduction in unnecessary spending.

You don’t have to do everything at once. Just keep moving the baseline up. The goal is to make progress that sticks – not sprint and collapse.

This is especially important for dual-income households. Coordinate your savings strategy so it feels balanced. Use joint financial planning tools or shared goals to keep both partners invested in the process.

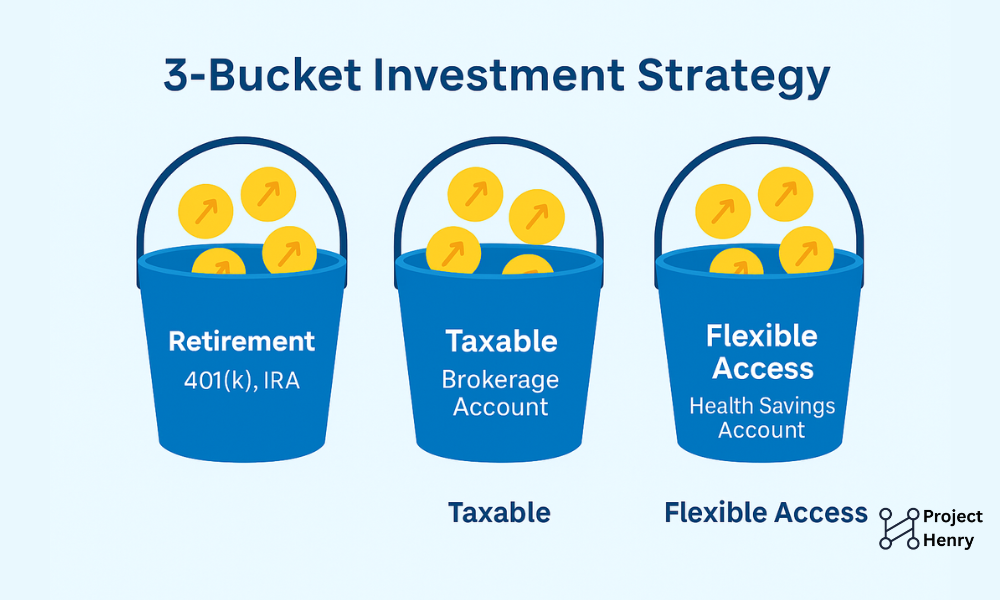

Choose the Right Accounts for the Right Goals

Where you save matters as much as how much you save. Max out tax-advantaged accounts first, then overflow into taxable investments.

Prioritize:

- 401(k) or 403(b) contributions up to the IRS limit (view the latest IRS contribution limits and tax guidelines)

- Roth IRA or Backdoor Roth, depending on eligibility

- HSA contributions if you have a qualifying health plan

- Taxable brokerage for early access and flexibility

For those with access, consider the Mega Backdoor Roth strategy or deferred compensation plans. These can supercharge your savings rate, especially in years with high bonuses or stock vesting.

Key Takeaways

Maximizing your savings rate doesn’t mean sacrificing your lifestyle. It means capturing your income intentionally and putting it to work. With automation, tiered targets, and tax-smart account use, you can scale your progress without burning out.

Reaching FIRE is not about cutting harder. It’s about building systems that let you save more without thinking about it.

🔥 Section 7: Optimize Income Streams (Primary, Secondary, Passive)

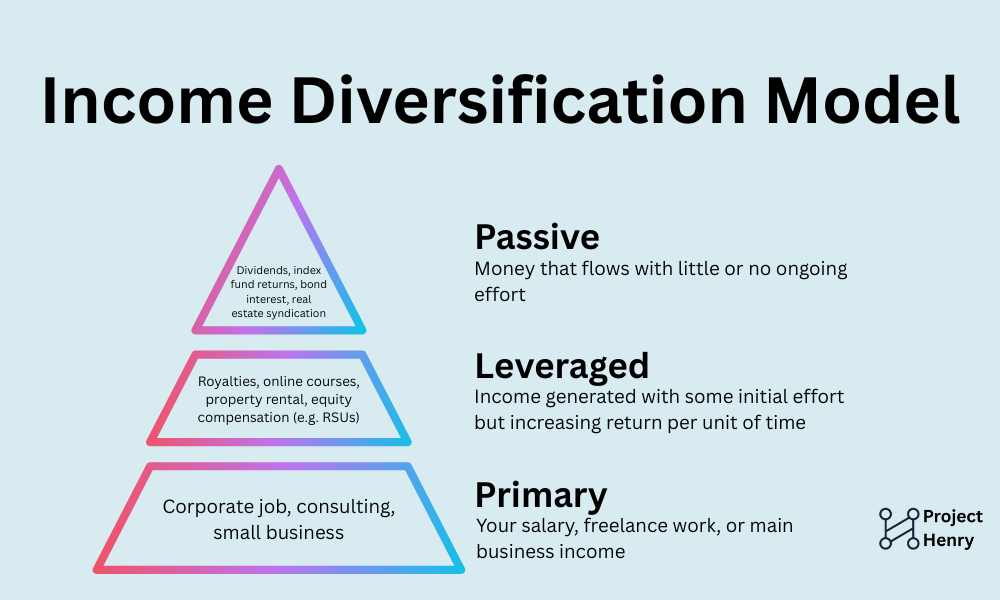

For many high earners, income feels strong on the surface but fragile underneath. A single salary, no matter how impressive, can limit flexibility and delay financial independence if it’s unsupported by other income sources.

Optimizing income doesn’t mean working more. It means making smarter use of your skills, your network, and your positioning – then building in layers of financial resilience over time.

Start With What You Control: Your Core Income

Your primary income is your most powerful financial tool, but it’s often underutilized. Promotions, lateral moves, or employer switches can increase compensation significantly, yet many professionals stay in roles that no longer reflect their market value.

For salaried employees, the fastest way to increase net worth may be one strategic negotiation. For self-employed professionals, adjusting your pricing model or focusing on higher-margin services can have an outsized impact. These aren’t side hustles. They’re structural improvements to your main source of cash flow.

Review your compensation every 12 to 18 months. Track your industry benchmarks. Understand your worth before others define it for you.

Expand Without Overextending

Once your core income is performing well, explore additional income opportunities that align with your lifestyle and skills. This is not about adding hours to your week – it’s about creating leverage.

The most effective secondary income channels tend to be strategic rather than reactive. They build on what you already know. A lawyer might offer limited consulting. A product manager might build a digital resource for new hires in tech. A dentist might invest in or advise a peer’s growing practice.

These streams should feel sustainable, not squeezed into leftover hours. The best ones deepen your expertise, increase your autonomy, or serve as testing grounds for longer-term transitions.

Build Stability Through Diverse Cash Flow

As you progress toward financial independence, focus on reducing dependency on any one income stream. This often means introducing slower-growing but more stable forms of income: structured investment portfolios, real estate exposure, royalties, equity stakes, or income-generating businesses.

Many HENRYs ignore passive income until late in their careers, assuming their salary will do the heavy lifting. But earlier diversification improves flexibility. It allows you to take calculated risks and smooths the path to a phased or partial retirement.

This kind of income doesn’t require reinvention. It requires intent. Small shifts, compounded over time, change your trajectory.

Key Takeaways

Income optimization is about structure, not strain. Begin by reviewing the value of your current role. Then layer in thoughtful income opportunities that enhance rather than deplete your energy. Finally, allocate time and capital toward building durable cash flow that supports long-term freedom. The most successful HENRYs are the ones who understand what best side hustles for high earners are and how to use them to their advantage.

When your income sources are designed intentionally, they become more than revenue. They become strategic assets that push you closer to independence – even when life shifts around you.

🔥 Section 8: Choose the Right Investment Strategy

High earners have a unique opportunity – and risk – when it comes to investing. Your income can support aggressive saving, but it also creates complexity. You’re managing taxes, overlapping accounts, equity compensation, and potentially a partner’s financial path too.

The right investment strategy isn’t about chasing returns. It’s about designing a portfolio that reflects your goals, timeline, and tax profile. Simplicity and consistency often outperform complexity, especially when time is limited and mental bandwidth is stretched.

Focus on Allocation Before Optimization

Before choosing specific assets, you need to define your overall allocation. This is the single most important decision in your investment plan. It determines your risk profile, potential growth, and ability to weather volatility.

Most FIRE-oriented HENRYs benefit from a diversified core portfolio made up of broad-market index funds – typically a combination of U.S. and international equities, fixed income for stability, and optional exposure to alternatives like real estate or private markets.

The exact ratio depends on your age, your target FIRE date, and how comfortable you are with short-term swings. A 35-year-old aiming to stop full-time work by 50 may lean heavily into equities, while someone starting later or with a more conservative outlook might shift toward balance earlier.

This isn’t about micromanaging the perfect split. It’s about having a clear, consistent framework that’s built to last.

Choose Investment Vehicles That Match Your Plan

Where your investments live matters just as much as what you invest in. Account selection affects your taxes, your liquidity, and your ability to access funds before traditional retirement age.

A HENRY-aligned investment strategy typically draws from three buckets:

- Tax-advantaged retirement accounts for long-term growth

- Taxable brokerage accounts for pre-retirement flexibility

- Optional hybrid tools like HSAs, cash-value life insurance, or real estate for specific use cases

Balance across these buckets lets you build both future security and near-term optionality. It also allows you to create a bridge strategy when you’re ready to shift out of full-time work.

If all your assets are locked in retirement accounts, you may hit your FIRE number but still be unable to use your funds freely. Planning this early avoids that trap.

Stick With What Works Long Enough to See Results

Investing successfully at a high income level isn’t about outsmarting the market. It’s about removing friction. You don’t need ten asset classes or constant rebalancing. You need a well-structured system you’ll actually follow.

This includes automating contributions, setting target allocations, rebalancing annually, and resisting the urge to react emotionally to short-term news cycles.

Time is your greatest advantage. You’re already ahead in income. A disciplined, streamlined portfolio lets compounding do the rest – without requiring daily effort.

Key Takeaways

The best investment strategy for high earners is one that removes guesswork and maximizes alignment with your goals. Start with clear allocation targets. Use the right accounts for the right timelines. Automate everything you can, then get out of the way.

Wealth grows when decisions are made early and followed consistently. In the next section, we’ll focus on tax efficiency – and how to protect your progress from unnecessary drag.

🔥 Section 9: Understand the Tax Code and Use It to Your Advantage

For high earners on the path to financial independence, tax strategy isn’t a side consideration. It’s a structural part of the plan. The more income you bring in, the more pressure taxes place on your ability to save, invest, and grow your wealth efficiently.

Even small inefficiencies compound quickly. A poorly timed bonus, an unchecked capital gain, or misallocated investments can quietly cost thousands per year. The solution isn’t aggressive loopholes. It’s understanding how the system works and making clear, informed decisions at each stage of your financial journey.

Identify Your Risk Zones Early

The tax system becomes more complicated as income increases. Most HENRYs encounter thresholds that impact deductions, phase out credits, or trigger additional taxes. If these aren’t planned for, they can drag on your progress year after year.

Many high earners are affected by:

- Diminished access to common deductions

- Exposure to the Alternative Minimum Tax

- Limited use of Roth IRAs or other contribution-restricted accounts

- Heavy taxation on equity compensation or bonus income

- Complex filing situations when both partners earn at high levels

This isn’t about exploiting tax codes. It’s about avoiding friction that slows down wealth building. Understanding where your pressure points are helps you make proactive adjustments that support your long-term goals.

Make Contributions Work on More Than One Level

Tax-advantaged accounts are foundational to any FIRE strategy, but for HENRYs, how and when you contribute matters just as much as how much.

Traditional 401(k) contributions reduce current taxable income, often significantly. Roth 401(k) options, if available, offer future tax relief and are worth considering when your current income is expected to fall in the future. Some employers allow after-tax contributions and in-plan conversions, enabling the Mega Backdoor Roth strategy – one of the few remaining ways to get large sums into Roth space.

Health Savings Accounts (HSAs), when eligible, are uniquely effective. They reduce taxable income now, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. When invested, they become long-term vehicles for healthcare in early retirement, bridging the gap before Medicare eligibility.

The aim here isn’t to follow every rule. It’s to understand which tools are available and how to layer them with intention.

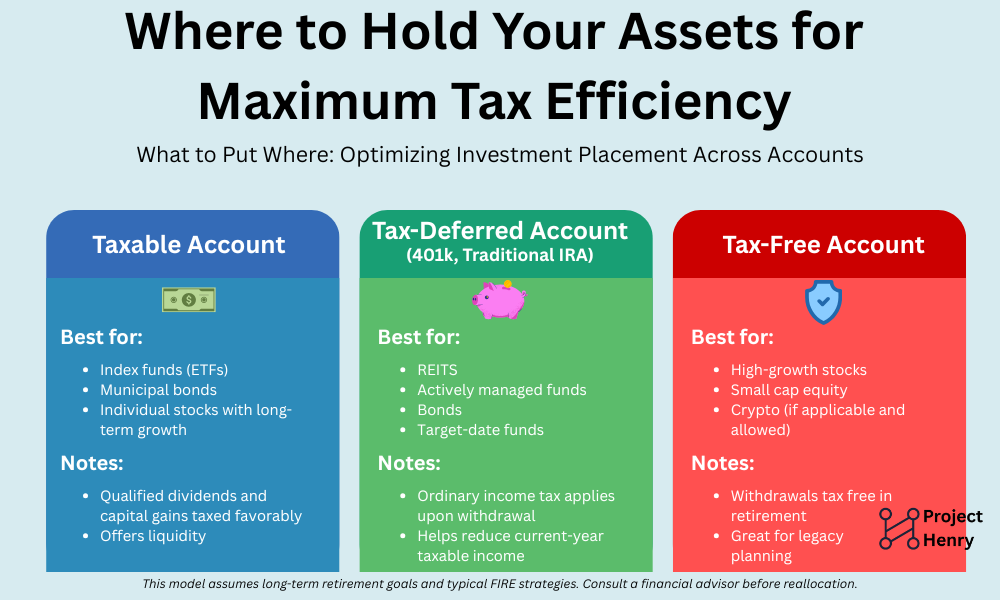

Invest With Tax Location in Mind

Investment allocation gets a lot of attention, but few high earners consider location – the placement of different asset types across account types.

Some investments generate consistent, high-tax income. Others are more tax-efficient by design. Matching the right investment to the right account can improve after-tax returns without changing your broader strategy.

In practical terms, interest-generating assets like bonds or REITs belong in tax-deferred accounts. Tax-efficient index funds and ETFs are often better placed in taxable brokerage accounts. Growth-focused assets with long time horizons can benefit most from being held in Roth accounts, where gains won’t be taxed later.

These decisions don’t require micromanagement. A simple system that keeps tax-heavy assets sheltered and growth assets where they can expand tax-free is usually enough.

Key Takeaways

Tax planning is one of the few areas where you can improve results without increasing effort. For high earners, the compounding impact of well-placed contributions, smart account use, and location-aware investing can unlock years of additional runway.

A strong savings rate builds momentum. A smart tax strategy keeps it from leaking away.

🔥 Section 10: Plan for Children, College, and Elder Care

For many HENRYs, financial independence isn’t just about stepping away from work. It’s about being able to support a family, plan for the future, and be present for the people who depend on you. That means thinking beyond your own retirement – and considering the financial lives of your children and your parents.

These aren’t side topics. They’re central to your FIRE strategy. And they’re often the missing pieces in advice aimed at single, mobile, ultra-frugal individuals with no dependents. You may be planning college savings while also navigating long-term care options for aging parents. That requires balance, intention, and flexibility.

Plan for Support, Not Just Survival

Raising children in a high-cost area while pursuing financial independence comes with trade-offs. You want to give your kids opportunities – through school choices, enrichment, or travel – without locking yourself into decades of extended work.

Rather than aiming to cover every possible expense, focus on where your financial support will have the most lasting impact. This could mean fully funding a 529 plan, helping with their first home deposit, or leaving a portfolio they can’t touch until they’re older.

It also means modelling what financial independence looks like. FIRE isn’t just about having money. It’s about showing the next generation how to build autonomy, avoid debt traps, and create meaningful options.

College Planning: Numbers and Philosophy

For many HENRYs, college is the largest planned expense outside retirement. But how you approach it depends on more than numbers.

Do you want to cover all costs or split them with your child? Are you aiming for in-state tuition, private schools, or international options? Is your goal to minimize loans or maximize opportunity?

529 plans remain a popular vehicle for high earners due to state tax benefits and investment growth. But remember, these accounts are most effective when started early and funded consistently. The compounding is powerful, but time-sensitive. Explore your state’s 529 plan rules and benefits on SavingforCollege.com

Also consider the flexibility of custodial brokerage accounts or keeping funds in your name for strategic FAFSA positioning. A rigid approach to college savings can limit your options later. Build enough structure to make progress, and enough flexibility to adapt.

Elder Care: The Silent Financial Load

Caring for aging parents is one of the most under-discussed realities in FIRE planning. Many HENRYs find themselves unexpectedly supporting parents through health issues, housing transitions, or financial shortfalls – often while raising kids and maintaining careers.

This form of support may not have a line item in your budget yet, but it should be on your radar. Even modest contributions, like helping with housing costs or medical expenses, can reshape your financial trajectory if they last for years.

Have honest conversations early. Understand whether your parents have long-term care insurance, wills, or end-of-life plans in place. Knowing what role you’re likely to play – and preparing for it emotionally and financially – can protect both your family and your FIRE timeline.

Key Takeaways

Financial independence doesn’t happen in isolation. Your plan needs room for more than just your retirement. Building in capacity to support your children’s future and your parents’ care is a sign of strength, not compromise.

It may take longer. It may cost more. But it results in a version of FIRE that’s grounded, resilient, and built to last.

🔥 Section 11: Use Location Arbitrage to Reach FIRE Faster

You can cut spending, increase savings, and optimize taxes – but geography might still be the single most powerful factor influencing your FIRE timeline.

For high earners, location often comes with trade-offs that are deeply embedded in your life. Proximity to work, school quality, family ties, and lifestyle preferences all play a role. But when you start looking at your city through a financial independence lens, the numbers can be startling.

A household earning $300,000 in San Francisco or New York may still feel squeezed after taxes, housing, and childcare. That same income, or even a reduced version of it, can stretch significantly further in lower-cost regions. The difference isn’t just marginal. It can reshape your timeline by a decade or more.

Understand the Leverage

Location arbitrage isn’t only about cost of living. It’s about increasing the spread between your income and your expenses. If you can maintain a portion of your current income while dramatically reducing outflows, your savings rate explodes.

That might mean:

- Keeping a remote role while relocating

- Taking a moderate pay cut in exchange for 40 percent lower expenses

- Starting a business in a more tax-efficient state

- Leaving a metro area at a strategic point in your children’s schooling or your career lifecycle

These shifts are rarely simple, but when timed well, they can create momentum that’s otherwise hard to replicate. And they often unlock lifestyle benefits you hadn’t considered – more time, more space, less pressure.

Reframe the Idea of “Home Base”

For many HENRYs, identity is tied closely to location. You’ve built a life in the city. You know the schools, the routines, the grocery stores. But part of financial independence is gaining the freedom to ask new questions.

Where would you live if your job didn’t dictate it? What environment would support your values, health, and time more effectively? Could you reduce your housing costs by half and still have access to the things that matter?

Some people use geographic arbitrage temporarily – taking a two- to five-year relocation to supercharge savings before returning. Others make a permanent shift and discover that less pressure brings more meaning.

This doesn’t have to mean moving to a rural area or compromising your lifestyle. Many mid-size cities offer culture, good schools, and growing job markets – without the crushing overhead of major metros.

Cities to Watch

There’s no perfect list, but some cities consistently offer value for high earners seeking more breathing room.

Places like Raleigh, Madison, Boise, Salt Lake City, Pittsburgh, and Asheville have seen an influx of professionals trading expensive coastal living for balance and margin. They offer strong infrastructure, access to nature, and space to build without needing $2 million just to own a home.

If you’re targeting a future FIRE move, consider state taxes as well. Florida, Texas, Nevada, and Washington have no state income tax, which can meaningfully extend your investment runway, especially in semi-retirement.

Compare regional cost of living data from the Bureau of Labor Statistics.

Key Takeaways

Relocating is never a simple choice, but it’s one of the few changes that can permanently alter the math of your financial life. If your income was built in a high-cost market, that leverage becomes even more powerful when expenses drop.

The question isn’t just where you can afford to live. It’s where your money and time will stretch far enough to support the life you actually want.

🔥 Section 12: Create a Withdrawal and Bridge Strategy

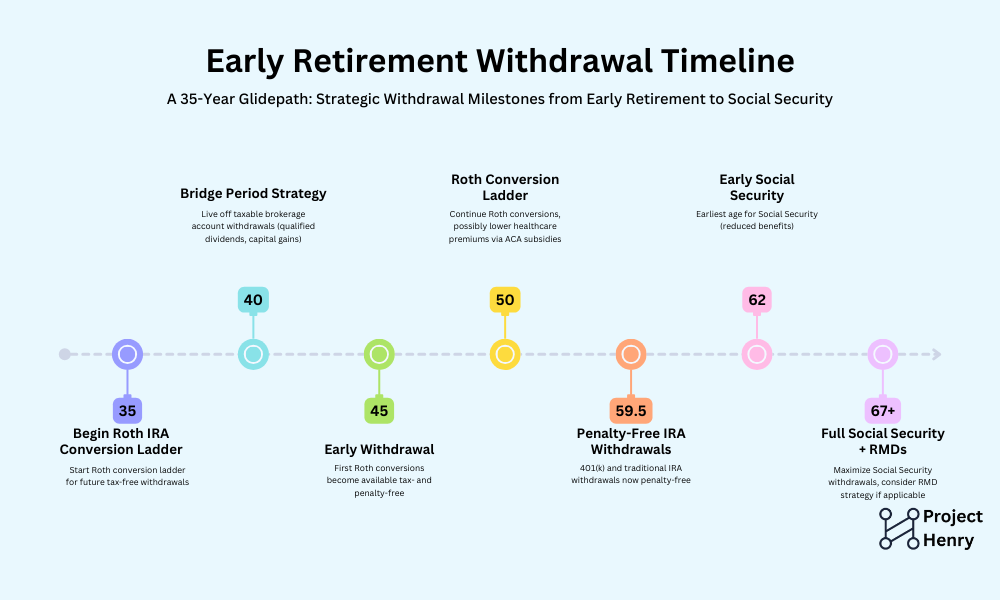

Reaching your FIRE number is a milestone. But unless you plan to work until 60, it’s not the final piece. The next challenge is accessing your money in a way that supports your lifestyle, protects your tax position, and bridges the gap until traditional retirement age.

Most retirement advice assumes you’ll begin withdrawals at 65. But if you plan to leave work at 45 or 50, there’s a decade or more where your accounts may be inaccessible, penalized, or inefficient to use. This phase needs its own roadmap – one that many high earners overlook until they’re already in it.

Understand the Gap Years

The years between your last paycheck and age 59.5 are known as the bridge period. If most of your wealth is in 401(k)s or IRAs, you may have millions on paper but little you can use without triggering taxes and penalties.

Building a smart bridge strategy means having liquid assets, flexible income sources, and well-sequenced withdrawals.

Your timeline might look like this:

- Ages 45–50: Living on brokerage withdrawals, RSUs, or business income

- Ages 50–59.5: Partial Roth conversions, SEPP strategies, or real estate cash flow

- Age 59.5+: Access to 401(k), IRA, and HSA funds without penalties

- Age 67+: Social Security and possible annuity income

Mapping this requires more than guesswork. You need a structured plan for where income will come from at each stage.

Use the Right Tools at the Right Time

There are several strategies to legally access retirement funds early – but each comes with trade-offs.

Roth conversion ladders involve moving money from a traditional account to a Roth IRA over several years, paying taxes now but avoiding penalties and allowing future withdrawals tax-free. It’s ideal for HENRYs expecting lower taxable income post-career.

Rule 72(t), or SEPP (Substantially Equal Periodic Payments), allows penalty-free IRA withdrawals at any age, but locks you into a rigid schedule. It offers flexibility in timing, but less flexibility once it begins.

Brokerage accounts with long-term capital gains treatment often serve as the primary funding source in early FIRE years. The more you’ve built here, the more breathing room you have in bridge planning.

Real estate or small business income can also smooth the transition – providing semi-passive cash flow during early withdrawal years, with the option to sell or exit later.

There is no one-size-fits-all here. The strategy depends on your mix of accounts, age, expenses, tax profile, and lifestyle.

Avoid the Pitfalls of Poor Sequencing

Withdrawals shouldn’t just be legal. They should be efficient. Poor sequencing can result in:

- Paying penalties you could have avoided

- Triggering unnecessary capital gains or higher Medicare premiums

- Locking in higher tax brackets early in retirement

- Burning through taxable accounts too quickly and losing flexibility later

The best bridge strategies minimize taxes over your entire retirement horizon, not just year one. They also preserve choice – giving you multiple ways to adjust based on health, market performance, or lifestyle changes.

Key Takeaways

Crossing the FIRE line doesn’t mean you’re finished planning. In many ways, the hardest financial work comes next. Designing a smart, flexible withdrawal plan protects your wealth and buys you the time and freedom you’ve worked for.

Start thinking about access, not just accumulation. Your future lifestyle depends on how and when your money moves – not just how much you’ve saved.

🔥 Section 13: FAQ – FIRE Questions for HENRYs

You’ve probably been running these questions through your head since the beginning. This is where we bring clarity to the most common sticking points for high earners trying to navigate FIRE with real-life responsibilities.

🔥 Section 14: Final Thoughts and Next Steps

If you’ve made it this far, you already know something important: FIRE isn’t just a dream for high earners. It’s a structural possibility. The challenge isn’t whether you make enough – it’s whether you use that income to build the life you actually want.

As a HENRY, your path is different. You face high taxes, high costs, and high expectations. But you also have rare advantages: strong income, educational capital, and room to maneuver. FIRE planning for you isn’t about living on rice and beans or quitting your job tomorrow. It’s about designing a system that gives you options.

Options to say no. To pivot. To walk away when something no longer serves your life.

Throughout this guide, we’ve shown how to:

- Understand your financial pressure points

- Define a FIRE number that reflects your real life

- Use your income efficiently through smart contributions and tax planning

- Sequence your accounts for both accumulation and withdrawal

- Build a flexible strategy that fits your timeline, not someone else’s

The next step isn’t doing everything at once. It’s choosing one thing to act on this week. Open your FIRE model spreadsheet. Reassess your 401(k) contributions. Book time with a fiduciary planner. Start a location exploration list. Whatever you choose, start moving. Progress builds momentum.

If you want help staying on track, consider joining our HENRY Insider email list. You’ll get weekly strategies, checklists, and advanced insights – all designed for high earners building real-world financial independence.

You don’t need to wait until everything is perfect. You just need to move with purpose. Your income gives you the power to shape your future. FIRE gives you the permission to design it on your terms.