Last updated: September 2025

You earn well, but it still feels tight. You’re not alone. Despite pulling in six figures, you’re watching every dollar, wondering why wealth feels so elusive. If you’re a high-earning professional earning $150k+ but still feel “not rich yet,” this comprehensive guide reveals proven strategies to diversify your income and accelerate your path to true financial independence.

Table of Contents

- Table of Contents

- Understanding the HENRY Income Challenge

- The Income-Wealth Paradox

- Why Side Hustles Matter for HENRYs

- High-Value Professional Side Hustles for High Earners

- Investment-Based Income Streams

- Digital Business Opportunities

- Real Estate & Property Income

- Tax-Optimized Side Income Strategies

- Getting Started: The 90-Day Side Hustle Action Plan High Earners

- Common Pitfalls to Avoid

- FAQs

Understanding the HENRY Income Challenge

The Income-Wealth Paradox

HENRYs represent a unique financial demographic – high earners caught between substantial salaries and genuine wealth accumulation. Research shows that 78% of high-income professionals live paycheck to paycheck, with only 10% feeling truly wealthy despite earning well above national averages.

The core challenge isn’t income generation – it’s income retention and multiplication. With effective tax rates often reaching 40-60% for high earners, combined with lifestyle inflation and major metropolitan living costs, traditional wealth-building advice falls short.

If you’re new to the HENRY concept or want to understand the deeper context behind these income-wealth dynamics, our comprehensive guide on core HENRY financial challenges provides the essential background for why side hustles are crucial for high earners.

Why Side Hustles Matter for HENRYs

Income diversification serves three critical functions for high earners:

Risk Mitigation: Your primary income, however substantial, represents a single point of failure. Professional side income provides insurance against job loss or industry disruption.

Tax Optimization: Multiple income streams create opportunities for tax-efficient wealth building through business deductions, retirement contributions, and strategic loss harvesting.

Wealth Acceleration: Side income invested aggressively can dramatically compress your timeline to financial independence.

High-Value Professional Side Hustles for High Earners

The best side hustles for HENRYs leverage existing expertise to generate premium hourly rates that justify time investment away from primary careers. These high-value professional side hustles for busy professionals focus on consulting, advisory work, and expert services that can command $150-$500+ per hour.

Consulting & Advisory Work

Income Potential: $150-$500 per hour

Time Investment: 5-15 hours per week

Best For: Professionals with 5+ years experience in specialized fields

Leveraging your existing expertise through consulting represents the fastest path to high-value side income. Unlike generic freelancing, professional consulting commands premium rates because you’re selling outcomes, not time.

Getting Started:

- Identify your unique value proposition within your industry

- Package expertise into specific deliverables (audits, strategy sessions, implementation plans)

- Start with your existing network—former colleagues, vendors, or industry contacts

- Create a simple one-page consulting agreement template

- Set boundaries: specific days/hours for client work

Tax Advantages: Consulting income allows for business expense deductions including home office, travel, professional development, and equipment purchases.

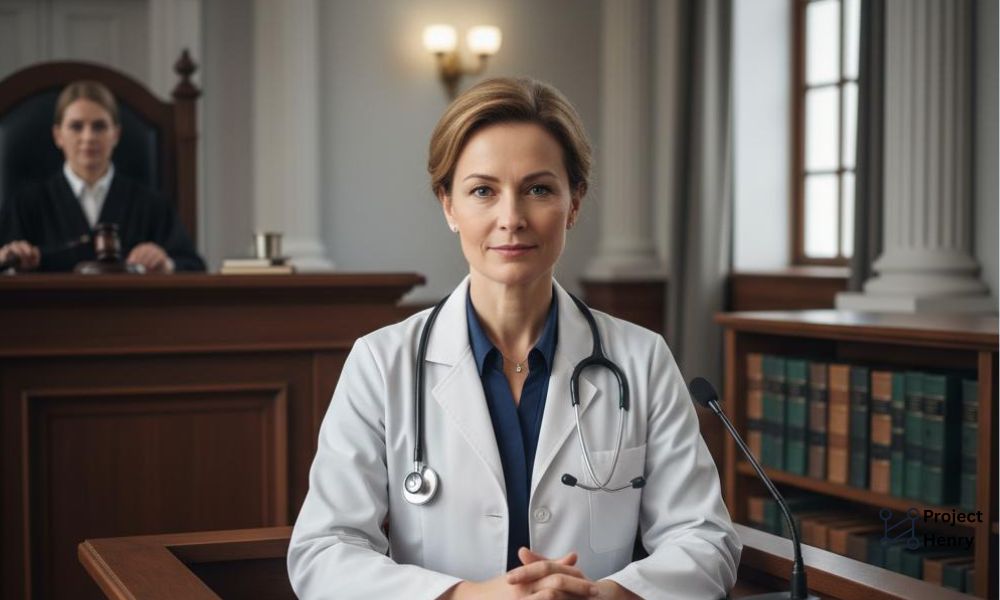

Expert Witness & Professional Testimony

Income Potential: $300-$800 per hour

Time Investment: Irregular, project-based

Best For: Licensed professionals (lawyers, doctors, engineers, architects)

Expert witness work offers some of the highest hourly rates available for professional side income. Legal proceedings require credible professionals to provide testimony on industry standards, professional practices, and technical matters.

Requirements:

- Professional licensure or recognized expertise

- Strong communication skills

- Ability to explain complex concepts clearly

- Neutral, credible professional reputation

Finding Opportunities:

- Register with expert witness directories

- Network with legal professionals

- Contact litigation support companies

- Maintain updated CV highlighting relevant experience

Board Service & Advisory Positions

Income Potential: $25,000-$100,000 annually per board

Time Investment: 10-20 hours per month

Best For: Senior professionals with leadership experience

Corporate board positions offer substantial compensation for relatively limited time investment. While competitive, many growing companies actively seek experienced professionals for advisory roles.

Types of Opportunities:

- Private company boards

- Nonprofit board positions

- Advisory committee roles

- Industry association leadership

Preparation:

- Develop board-ready resume focusing on governance experience

- Complete director education programs

- Network within your industry for referrals

- Consider starting with nonprofit boards to build experience

Investment-Based Income Streams

Smart income diversification for high earners extends beyond active work into passive investment strategies that generate cash flow while you sleep. These investment-focused side hustles for six figure earners provide the scalability and tax efficiency that traditional gig work cannot match.

High-Yield Real Estate Investment Trusts (REITs)

Income Potential: 6-12% annual returns

Initial Investment: $1,000 minimum

Best For: Passive income seekers with limited time

REITs provide real estate exposure without direct property management responsibilities. For time-constrained HENRYs, publicly traded REITs offer liquidity and professional management while generating regular dividend income.

REIT Categories:

- Residential REITs: Apartment complexes, single-family homes

- Commercial REITs: Office buildings, retail centers

- Industrial REITs: Warehouses, distribution centers

- Healthcare REITs: Medical facilities, senior housing

Strategy: Allocate 10-20% of investment portfolio to diversified REIT holdings through tax-advantaged retirement accounts to maximize after-tax returns.

Private Lending & Peer-to-Peer Investments

Income Potential: 8-15% annual returns

Initial Investment: $5,000-$25,000 minimum

Best For: Accredited investors seeking alternative investments

Private lending platforms allow high-income individuals to earn interest by funding business loans, real estate projects, or consumer credit. These investments often provide higher yields than traditional fixed-income securities.

Popular Platforms:

- YieldStreet: Alternative investments including real estate, marine, legal

- Fundrise: Real estate crowdfunding with low minimums

- PeerStreet: Real estate debt investments

- Prosper: Peer-to-peer consumer lending

Risk Management: Limit private lending to 5-10% of total investment portfolio and diversify across multiple platforms and investment types.

Dividend Growth Investing

Income Potential: 4-8% annual dividend yield plus growth

Initial Investment: No minimum

Best For: Long-term wealth builders

Dividend growth investing focuses on companies with histories of consistently increasing dividend payments. This strategy provides growing passive income while building long-term wealth through capital appreciation.

Key Strategies:

- Dividend Aristocrats: S&P 500 companies with 25+ years of consecutive dividend increases

- Dividend Kings: Companies with 50+ years of dividend growth

- International Dividends: Foreign companies offering higher yields

- REITs & Utilities: Higher-yielding sectors for current income

Tax Efficiency: Hold dividend stocks in taxable accounts to benefit from qualified dividend tax rates (0%, 15%, or 20% vs. ordinary income rates).

Digital Business Opportunities

The highest paying side hustles for professionals often exist in the digital realm, where expertise can be packaged and sold at scale without trading time for money. These digital income diversification strategies allow HENRYs to build assets that generate revenue beyond their active participation.

Online Course Creation

Income Potential: $50,000-$500,000+ annually

Time Investment: 100-200 hours initial creation, 5-10 hours weekly maintenance

Best For: Professionals with teachable expertise

Online education represents a massive growth opportunity, with the global e-learning market projected to reach $1 trillion by 2027. High-earning professionals possess valuable knowledge that others will pay to learn.

Course Development Process:

- Market Validation: Survey your network about learning needs

- Content Planning: Outline curriculum with specific learning outcomes

- Production: Create video content, workbooks, and assessments

- Platform Selection: Choose between Teachable, Thinkific, or custom solutions

- Marketing: Leverage professional networks and content marketing

Revenue Models:

- One-time Purchase: $297-$2,997 per course

- Subscription Model: $29-$99 monthly for course library access

- Cohort-Based Courses: $1,000-$5,000 for live, interactive programs

Professional Coaching & Mentoring

Income Potential: $100-$300 per hour

Time Investment: 10-20 hours per week

Best For: Experienced professionals passionate about developing others

Executive coaching and professional mentoring command premium rates while providing flexible scheduling. Many HENRYs successfully transition expertise into coaching businesses that eventually replace their primary income.

Coaching Specializations:

- Career Transition: Helping professionals change industries or advance

- Leadership Development: Executive presence and management skills

- Industry-Specific: Finance, technology, healthcare, legal specializations

- Life Coaching: Work-life balance, productivity, goal achievement

Getting Started:

- Obtain coaching certification (ICF-accredited programs preferred)

- Define your ideal client profile and specialty

- Create coaching packages with clear outcomes

- Build referral network through professional associations

- Develop content marketing strategy to demonstrate expertise

E-commerce & Amazon FBA

Income Potential: $100,000-$1,000,000+ annually

Time Investment: 20-40 hours weekly initially, 10-15 hours for established business

Best For: Analytical professionals comfortable with data-driven business

Amazon FBA (Fulfillment by Amazon) allows high-earning professionals to build scalable product businesses without handling inventory or shipping. Success requires market research, product sourcing, and brand building skills that many professionals already possess.

FBA Business Models:

- Private Label: Source generic products and create your own brand

- Wholesale: Buy brand-name products in bulk and resell

- Retail Arbitrage: Find discounted products to resell at higher prices

- Online Arbitrage: Purchase online deals for resale on Amazon

Key Success Factors:

- Thorough product research using tools like Jungle Scout or Helium 10

- Quality control and supplier relationship management

- Amazon advertising optimization

- Inventory management and cash flow planning

Real Estate & Property Income

Real estate represents one of the most proven side hustles for high earners, offering both cash flow and tax advantages that align perfectly with professional income levels. These property-based income diversification high earners strategies leverage strong credit profiles and substantial incomes to access deals unavailable to average investors.

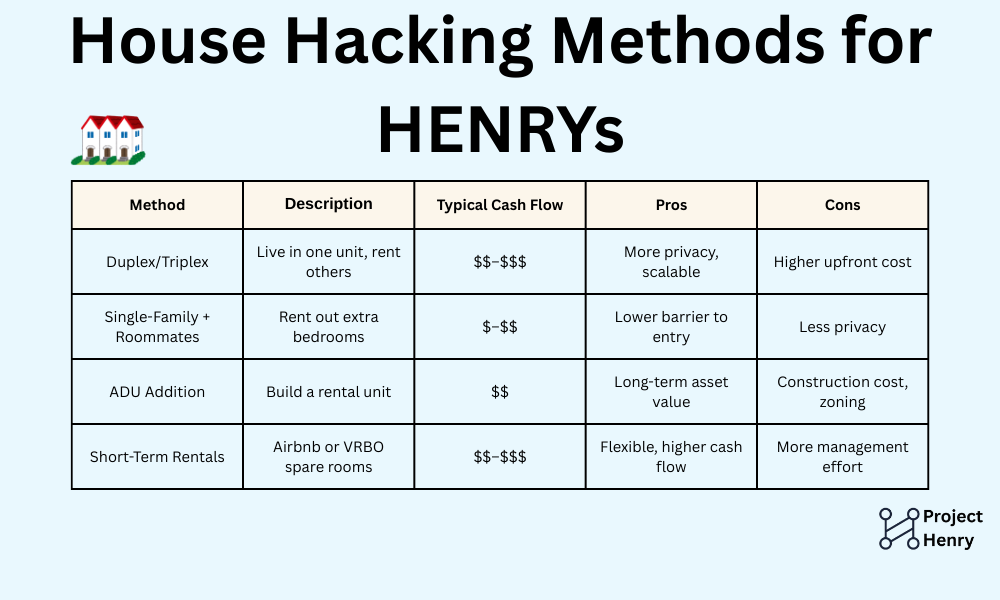

House Hacking Strategies

Income Potential: $500-$2,000 monthly cash flow

Initial Investment: 3.5-25% down payment

Best For: First-time real estate investors

House hacking involves purchasing a property, living in part of it, and renting out the remainder to offset housing costs. This strategy allows high earners to enter real estate investing while reducing living expenses.

House Hacking Methods:

- Duplex/Triplex: Live in one unit, rent others

- Single-Family: Rent out bedrooms to roommates

- ADU Addition: Build accessory dwelling unit for rental income

- Short-Term Rentals: Rent spare rooms on Airbnb

Financing Advantages:

- FHA loans with 3.5% down payment for owner-occupied properties

- Conventional loans with 5% down for primary residence

- VA loans (0% down) for qualifying veterans

BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat)

Income Potential: $300-$1,500 monthly cash flow per property

Initial Investment: $25,000-$75,000 per property cycle

Best For: Hands-on investors with renovation experience or reliable contractors

The BRRRR strategy allows investors to build real estate portfolios using recycled capital. By improving properties and refinancing based on higher values, investors can extract their initial investment while maintaining cash-flowing rental properties.

BRRRR Process:

- Buy: Purchase undervalued property needing improvements

- Rehab: Renovate to increase value and rental potential

- Rent: Secure quality tenants at market rents

- Refinance: Obtain new loan based on improved value

- Repeat: Use extracted equity for next property purchase

Success Requirements:

- Strong market knowledge for identifying opportunities

- Reliable contractor network for efficient renovations

- Understanding of local rental demand and pricing

- Conservative approach to renovation budgets and timelines

Short-Term Rental Management

Income Potential: $75,000-$250,000 annually

Time Investment: 20-30 hours weekly

Best For: Detail-oriented professionals in tourist-heavy areas

Managing short-term rental properties for other owners provides income without property ownership requirements. Many property owners lack time or expertise to maximize Airbnb revenue and will pay management fees for professional oversight.

Service Offerings:

- Property listing optimization

- Guest communication and booking management

- Cleaning and maintenance coordination

- Pricing strategy and revenue optimization

- Guest experience enhancement

Revenue Model: 20-30% of gross rental revenue plus setup fees

Tax-Optimized Side Income Strategies

The best side hustles HENRYs can pursue must account for complex tax situations where additional income could push earners into higher brackets or trigger benefit phase-outs. Understanding tax-optimized structures turns potential liabilities into wealth-building opportunities for high-income professionals. Before exploring additional investment streams, ensure you’re maximizing your 401k contributions as a high earner – this foundational step creates more room in your budget for alternative investments.

Business Structure Selection

Proper business structure selection can significantly impact your side income tax liability. High earners should carefully consider entity types based on income levels and long-term goals.

Sole Proprietorship

- Best For: Simple service businesses under $50,000 annually

- Tax Treatment: Income taxed at ordinary rates plus self-employment tax

- Advantages: Simple setup and minimal administrative requirements

Single-Member LLC

- Best For: Service businesses with liability concerns

- Tax Treatment: Pass-through taxation (same as sole proprietorship)

- Advantages: Liability protection, professional credibility, banking benefits

S-Corporation Election

- Best For: Service businesses generating $60,000+ annually

- Tax Treatment: Reduced self-employment tax on distributions

- Requirements: Reasonable salary must be paid to owner-employee

- Advantages: Potential tax savings on self-employment tax

Retirement Plan Contributions

Side business income creates opportunities for additional retirement contributions beyond employer-sponsored plans.

SEP-IRA Contributions

- Contribution Limit: 25% of self-employment income or $66,000 (2024)

- Best For: Solo entrepreneurs with high side income

- Benefits: High contribution limits, simple administration

Solo 401(k) Plans

- Contribution Limit: $66,000 plus $7,500 catch-up (50+) in 2024

- Advantages: Higher contribution limits than SEP-IRA

- Requirements: No employees other than spouse

Business Expense Optimization

Side businesses generate numerous deductible expenses that can reduce overall tax liability.

Home Office Deduction

- Simplified Method: $5 per square foot up to 300 sq ft

- Actual Method: Percentage of home expenses based on office space

- Requirements: Exclusive business use of designated space

Business Equipment & Software

- Section 179 Deduction: Up to $1,080,000 immediate expensing (2024)

- Bonus Depreciation: 80% first-year depreciation on qualifying property

- Common Deductions: Computers, software, professional equipment

Travel & Professional Development

- Business Travel: Transportation, lodging, 50% of meals

- Professional Education: Courses, conferences, certifications

- Networking: Professional memberships, business entertainment

Getting Started: The 90-Day Side Hustle Action Plan High Earners

This proven framework transforms side hustle ideas into actionable income diversification strategies specifically designed for busy professionals earning six figures. The 90-day approach ensures high earners can systematically build additional revenue streams without overwhelming their primary career responsibilities.

These side hustle income streams work best when integrated into a comprehensive FIRE planning strategy designed specifically for high earners balancing current lifestyle needs with future independence goals.

Days 1-30: Foundation Building

Week 1: Assessment & Goal Setting

- Complete comprehensive skills and experience audit

- Identify three potential side income opportunities aligned with expertise

- Set specific financial goals (target monthly income, timeline)

- Research market demand and competition for chosen opportunities

Week 2: Business Structure & Legal Setup

- Consult tax professional regarding optimal business structure

- Register business entity if required

- Obtain necessary licenses or permits

- Open dedicated business banking account

Week 3: Platform & System Creation

- Build professional website or portfolio

- Create social media profiles for business

- Set up accounting system (QuickBooks, FreshBooks)

- Develop basic marketing materials (business cards, one-page flyer)

Week 4: Initial Market Testing

- Reach out to five potential clients or customers

- Offer free consultation or discounted trial service

- Gather feedback on pricing, positioning, and value proposition

- Refine offering based on market response

Days 31-60: Implementation & Growth

Week 5-6: Service Delivery & Refinement

- Complete first paid projects or transactions

- Document processes and create standard operating procedures

- Collect client testimonials and case studies

- Identify areas for improvement in service delivery

Week 7-8: Marketing & Business Development

- Launch content marketing strategy (blog, LinkedIn articles)

- Network within industry associations and professional groups

- Ask satisfied clients for referrals and recommendations

- Explore partnership opportunities with complementary businesses

Days 61-90: Scaling & Optimization

Week 9-10: Process Automation

- Implement scheduling and client management systems

- Create email templates and proposal templates

- Set up automated invoicing and payment processing

- Develop standard contracts and service agreements

Week 11-12: Performance Analysis & Growth Planning

- Review financial performance against goals

- Analyze time investment vs. income generated

- Identify bottlenecks limiting growth

- Create plan for next quarter expansion or optimization

Common Pitfalls to Avoid

Even the highest paying side hustles for professionals can become wealth destroyers if common mistakes aren’t avoided from the start. These critical insights help HENRYs navigate the unique challenges of income diversification while maintaining their primary earning potential and avoiding costly errors.

Time Management Failures

The biggest risk for high-earning professionals is letting side hustles consume time disproportionate to their value. Calculate your effective hourly rate regularly and ensure side income justifies time investment.

Solution: Set strict boundaries around side hustle time and regularly evaluate ROI. If your side income generates less than 50% of your primary hourly rate, consider whether the time is better invested elsewhere.

Tax Compliance Issues

Many professionals underestimate tax implications of side income, leading to unexpected tax bills and compliance problems.

Solution: Consult with tax professional early in the process. Set aside 25-35% of side income for taxes and make quarterly estimated payments to avoid penalties.

Employer Conflict of Interest

Some side hustles may violate employer agreements or create conflicts of interest that could jeopardize your primary income.

Solution: Review employment agreements carefully and disclose potential conflicts to HR or legal departments when appropriate. Never compete directly with your employer or solicit their clients.

Over-Leveraging Real Estate

Real estate investing can be lucrative but carries significant risks, especially when using high levels of debt.

Solution: Maintain conservative debt-to-income ratios and ensure adequate cash reserves for vacancy and maintenance periods. Never invest in markets you don’t understand thoroughly.

FAQs

Start with 10-15 hours per week maximum. High earners often overcommit to side projects, burning out and damaging performance in their primary role. Focus on high-value activities that leverage your existing skills rather than time-intensive projects requiring steep learning curves.

Consulting in your area of expertise typically offers the best risk-adjusted return. You can command premium rates immediately without significant upfront investment. As you generate consulting income, reinvest profits into passive income streams like real estate or dividend-paying investments.

For most service-based side hustles generating under $50,000 annually, the administrative burden may outweigh benefits. However, LLCs provide liability protection and professional credibility. Consult a tax professional to evaluate your specific situation, considering income level, business type, and liability exposure.

Review your employment agreement carefully, particularly non-compete and confidentiality clauses. Avoid any side activities that compete directly with your employer or use proprietary information. When in doubt, discuss potential conflicts with HR or seek legal advice.

Start with a goal of 10-20% additional income from side activities. This provides meaningful financial impact without overwhelming your schedule. As you develop systems and expertise, you may choose to increase this percentage or transition to full-time entrepreneurship.

Service-based side hustles (consulting, coaching) can generate income within 30-60 days. Product-based businesses and real estate investments typically require 6-12 months to reach meaningful cash flow. Digital businesses like courses or e-commerce may take 3-6 months to develop but can scale more rapidly once established.

For HENRYs, the best strategy is usually to reinvest the first $50,000-100,000 of side income into wealth-building activities rather than lifestyle inflation. This creates compound growth that can dramatically accelerate your path to financial independence. Once you’ve built substantial passive income streams, you can safely increase lifestyle spending.

The best side hustles for HENRYs require a fundamentally different approach than traditional income diversification strategies. As a high earner not yet rich, your path to true wealth lies not in low-paying gig work, but in leveraging your existing expertise and strong financial position to create multiple high-value revenue streams. Whether through professional consulting, investment-based income, digital business opportunities, or strategic real estate investments, the highest paying side hustles for professionals are those that complement rather than compete with your primary career while optimizing for tax efficiency and time management.

The journey from high earner to genuinely wealthy requires more than just a good salary—it demands strategic income diversification that builds lasting assets and passive income streams. By implementing the tax-optimized strategies and avoiding common pitfalls outlined in this guide, you can accelerate your timeline to financial independence while maintaining the lifestyle and career advancement that matter to you. Remember, the goal isn’t to work more hours, but to work smarter with side hustles for six figure earners that multiply your wealth-building potential.

Ready to take your income diversification to the next level? Join our HENRY Insider email community for exclusive weekly strategies, advanced tax optimization tips, and insider access to high-value opportunities specifically curated for high-earning professionals. Get actionable insights delivered directly to your inbox and connect with other ambitious HENRYs on the path to true financial independence.

Disclaimer: This article provides general information only and does not constitute financial, tax, or legal advice. Consult qualified professionals regarding your specific situation before making investment or business decisions. Tax laws and regulations change frequently; verify current requirements with appropriate professionals.

The information in this guide reflects data and research available as of September 2025. Always verify current tax rates, contribution limits, and legal requirements before implementing any strategies discussed.