Introduction: The HENRY Reality in 2025

You earn well – but it still feels tight. You’re not alone.

- Introduction: The HENRY Reality in 2025

- Who Is a HENRY in 2025? [Definition & Demographics]

- Why Do HENRYs Feel “Not Rich Yet”?

- The 2025 HENRY Financial Challenge Map

- HENRY Income vs. Wealth: Breaking Down the Paradox

- Retirement and Investment for HENRYs

- Tax Planning Strategies for 2025

- Family, Kids, and Future Planning

- Mistakes, Pitfalls, and What to Avoid

- Digital Tools and Calculators for HENRYs

- FAQ: HENRYs in 2025

- Related Guides, Next Steps, and Conclusion

If you’re in your late 20s, 30s, or early 40s, earning a combined household income of $150,000 to $500,000+ in the US, chances are you’ve felt the “HENRY squeeze.” Maybe you’ve landed that tech, finance, legal, or medical job you worked years to achieve. Maybe you’ve bought a house in a great neighborhood, are paying off student loans, and balancing childcare with career advancement. But despite your six-figure income, real wealth – and real financial security – still seems just out of reach.

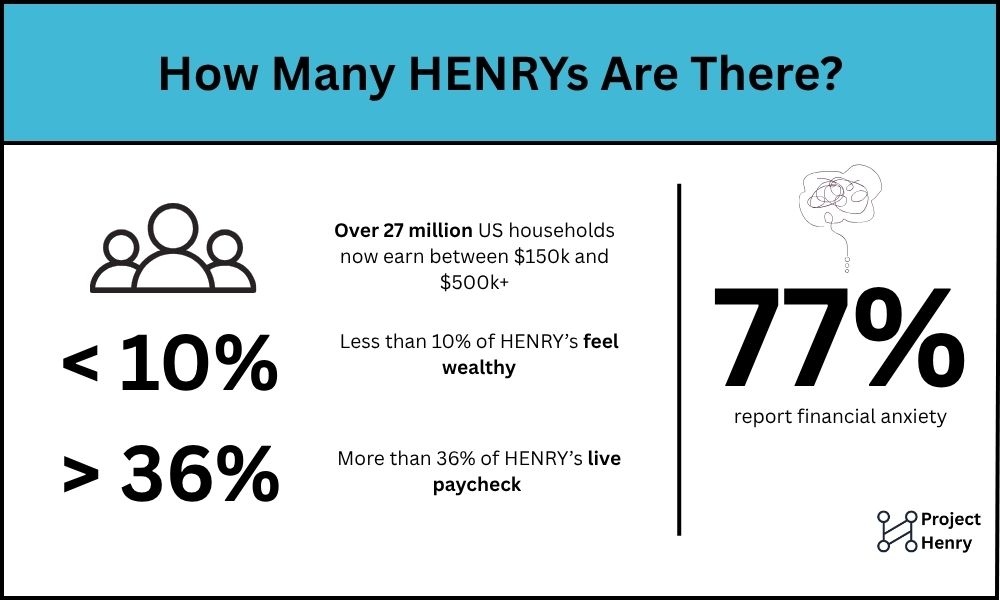

This paradox is what defines the HENRY: High Earner, Not Rich Yet. In 2025, more than 27 million American households fit this profile – making up the top 2–3% of earners, but far fewer feel truly wealthy or at ease . According to recent surveys, over 36% of US households earning $250,000 or more still live paycheck-to-paycheck, and a striking 77% lose sleep over financial worries .

Why does this happen?

It’s not a lack of discipline or ambition. HENRYs are often highly educated, dual-income professionals – doctors, lawyers, engineers, tech managers, business owners – living in or near America’s most dynamic (and expensive) cities. The reality of 2025:

- Housing prices and rents have soared, especially in metro areas like NYC, the Bay Area, Boston, LA, and DC.

- Childcare and education costs are at historic highs.

- Healthcare premiums, student loan payments, and property taxes eat away at even the largest paychecks.

- Federal and state taxes hit harder at higher incomes, with many deductions phased out and the AMT (Alternative Minimum Tax) lurking for high earners.

- Lifestyle inflation is real: when you finally “make it,” expectations (and costs) climb.

And yet, HENRYs often face skepticism or even judgment when they voice financial stress. “How can you struggle making $200k a year?” The answer is simple: today’s high income does not guarantee financial peace of mind – especially for mid-career professionals in high-cost urban and suburban America.

This guide was created for you – the ambitious, responsible, family-focused high earner who wants to feel as successful as you are on paper. We’ll break down exactly what it means to be a HENRY in 2025, using the latest data and practical frameworks. You’ll find:

- A clear definition and profile of HENRYs today

- The specific financial and psychological challenges high earners face

- Why “not rich yet” is the norm – not the exception

- Actionable, US-specific strategies for taxes, housing, student loans, retirement, family, and more

- Interactive tools, calculators, and downloadable resources – all tailored to your unique situation

If you’re feeling financially anxious, overwhelmed by complex choices, or simply wondering where all your money goes – you’re not alone. The HENRY squeeze is real, and it’s not your fault. But there are solutions, and this guide is your roadmap.

Let’s get started – first, with a closer look at what makes someone a HENRY in 2025.

Who Is a HENRY in 2025? [Definition & Demographics]

What exactly does it mean to be a HENRY in the United States in 2025?

A HENRY, or High Earner Not Rich Yet, is not just a clever acronym. It is a precise label for millions of Americans who enjoy top-tier incomes but are still working toward true financial freedom. While you might appear “wealthy” from the outside, the reality is more nuanced.

Core HENRY Criteria (2025 Update)

Income:

- Household income typically ranges from $150,000 to $500,000 or more.

- Individual earners often start at $100,000 plus, but the “classic” HENRY profile is a dual-income household at $200,000 to $400,000.

Age:

- Most HENRYs are between 28 and 45 years old.

- This group includes older Millennials and younger Gen X professionals in the prime of their careers.

Education and Profession:

- HENRYs are highly educated. Over 90 percent hold at least a bachelor’s degree, and many have advanced degrees like an MBA, JD, MD, or PhD.

- Most work in high-demand, well-compensated fields:

- Medicine (physicians, dentists, specialists)

- Law (attorneys, partners, corporate counsel)

- Technology (software engineers, product managers, IT consultants)

- Finance (bankers, analysts, accountants)

- Engineering and architecture

- Business owners, entrepreneurs, and management consultants

Household and Family:

- Roughly 75 percent are married or partnered, and 68 percent have children, often between 1 and 3 per household.

- About 78 to 88 percent own their home, but many carry large mortgages, especially in high-cost areas.

- Dual-income families are the norm, not the exception.

Geography:

- HENRYs are concentrated in high-cost urban centers and affluent suburbs.

- The biggest clusters are found in New York City, San Francisco Bay Area, Boston, Washington DC, Chicago, Seattle, and Los Angeles.

- Many also live in lower-cost metros such as Dallas, Atlanta, Charlotte, and Denver, but the financial pressures can look very different in those places.

Quick HENRY Profile Table (2025)

| Attribute | Typical Range / Example |

|---|---|

| Age | 28 to 45 |

| Household Income | $150,000 to $500,000 plus |

| Individual Income | $100,000 plus |

| Education | Bachelor’s or higher, many advanced |

| Occupation | Med, law, tech, finance, business, etc |

| Homeownership | 78 to 88 percent |

| Geography | Major metros and affluent suburbs |

| Children | 68 percent (average 2.1 per home) |

| Family Structure | Dual-income, married/partnered |

Why Is This Definition Important?

The HENRY label helps clarify why so many high earners still feel financially stuck.

- You are not the ultra-wealthy. Private banking, concierge investment services, and multi-million dollar inheritances are not your reality.

- You are not middle-class either. Your household finances are vastly more complex than average, with bigger stakes for each decision.

- You live in the “missing middle” of financial advice – caught between mainstream budgeting tips and guidance for the ultra-rich.

In short, HENRYs are America’s “working rich” – high earners who are still chasing genuine wealth, security, and peace of mind.

Why Do HENRYs Feel “Not Rich Yet”?

It seems counterintuitive. How can someone earning $200,000 or $300,000 a year not feel wealthy? Why do so many high earners experience the same financial stress, anxiety, and insecurity as families making a fraction of their income? The answer is a perfect storm of lifestyle inflation, relentless living costs, and psychological pressures unique to the HENRY demographic.

Lifestyle Inflation and the Cost of Success

For many HENRYs, higher pay was supposed to bring relief. Instead, every step up the ladder seems to bring new costs and obligations. Promotions, job changes, or moving into a new income bracket are often followed by bigger homes, private school tuition, luxury cars, upgraded vacations, and more frequent dining out. Social circles change too, and with them, expectations about what “normal” looks like. It is easy to feel like you are just keeping up, even as your discretionary spending rises year after year. Data from 2024 shows that the average HENRY household spends around $68,000 annually on non-essentials like travel, shopping, premium services, and experiences.

Lifestyle creep is often subtle. After years of hard work, high earners feel justified in enjoying some of the perks their income brings. Yet, these upgrades can quickly become necessities in the family budget. The reward for success is more work, more costs, and often more pressure to provide a high-quality lifestyle for children and loved ones.

The High-Cost Metro Squeeze

Where you live matters more than ever. The majority of HENRYs are based in the most expensive metro areas in the country: New York, San Francisco, Los Angeles, Boston, and Washington DC. In these cities, even a six-figure salary can feel “middle class” at best. Median home prices are now over $1 million in many of these locations. Property taxes, homeowner insurance, and maintenance costs are rising steadily. For families, monthly childcare bills can range from $1,500 to $4,000 per child. Health insurance premiums for a family plan frequently top $1,200 per month, not including high deductibles and out-of-pocket maximums.

If you map out a typical HENRY household budget in New York or San Francisco, it is common to see most of that high salary quickly claimed by housing, taxes, childcare, and commuting costs. What remains is often just enough to keep up with the Joneses, not to build real wealth.

Dual-Income Households and Family Pressure

Most HENRY households are powered by two professionals, both working full time or close to it. This structure brings in more income but also more complexity. Families juggle demanding jobs, young children, and a packed calendar of school, activities, and travel. Many hire help for housecleaning, meal prep, or childcare – another major expense in the monthly budget.

At the same time, HENRYs often do not qualify for government benefits or tax credits that help other families manage child or healthcare costs. They are, in a sense, “too rich for help, too stretched for comfort.” The net effect is a feeling of living on a treadmill, working harder than ever but never quite able to stop and enjoy the view.

The Psychological Toll: Why It Feels Lonely

Financial anxiety is not just about numbers. HENRYs frequently report a sense of isolation in their financial struggles. Cultural attitudes often dismiss their worries – after all, how can someone making $250,000 possibly have trouble? Yet over one-third of high earners say they live paycheck-to-paycheck, and three-quarters report losing sleep over money issues. For some, there is a fear of falling behind, of missing out on investment opportunities, or not being able to provide the “right” advantages for their children.

In private conversations and online forums, HENRYs describe feeling caught between worlds. They make too much to feel “average,” but not enough to feel secure. This creates a constant pressure to optimize, to keep searching for better strategies, and to rarely feel satisfied with their progress.

![Monthly Spending Breakdown for a HENRY Family [USA Edition]](https://highearners.net/wp-content/uploads/2025/08/Monthly-Spending-Breakdown-for-a-HENRY-Family-USA-Edition.jpg)

For details and sources behind this chart, see: Investopedia, NerdWallet, CNBC, and our HENRY market research reports.

The 2025 HENRY Financial Challenge Map

The financial reality for HENRY households in 2025 is shaped by a unique set of pressures that few mainstream personal finance articles address honestly. Earning a top-tier income does not mean you are immune to financial stress or mistakes. In fact, the very factors that push your household into the high-income bracket – living in dynamic cities, building careers that require advanced degrees, investing in family and education – often create a financial tightrope that is easy to underestimate.

Below is a breakdown of the most pressing challenges facing high earners today.

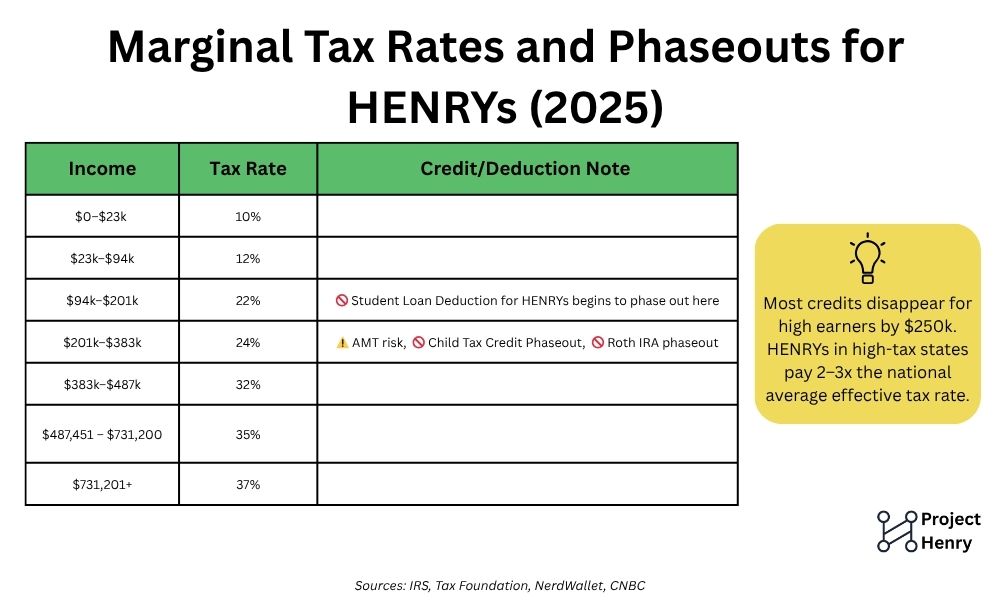

The Tax Trap: High Incomes, Heavier Tax Burdens

HENRYs pay a disproportionate share of the tax base, and every year the rules seem to get more complex. At a $250,000 household income, you are likely in the 32 percent or 35 percent federal tax bracket. In states like California or New York, you can add another 9 to 13 percent in state and sometimes even city taxes. That means your effective tax rate can approach or even exceed 40 percent, especially when you factor in payroll taxes, phaseouts, and the Alternative Minimum Tax (AMT).

The AMT is particularly frustrating for high earners. It was originally designed to prevent the ultra-wealthy from avoiding taxes, but today it ensnares dual-income professionals, especially those who live in states with high property and income taxes. The state and local tax (SALT) deduction cap of $10,000 remains in effect for 2025, which limits the benefit of itemizing for those in expensive zip codes.

On top of this, many deductions and credits phase out for incomes above $200,000. Child tax credits, student loan interest deductions, and certain education or childcare credits are often unavailable to HENRYs. The result is a situation where you may pay tens of thousands more in taxes than your middle-income peers, but receive little extra support.

Housing Affordability: When Homeownership Means House Poor

Owning a home is still a central part of the American dream, but for HENRYs in major metros, it often means signing up for a lifetime of high payments. In San Francisco, New York, Boston, or Seattle, a modest family home can easily cost $1.2 million or more. At current mortgage rates (often around 6 to 7 percent), a 20 percent down payment leaves you with a monthly payment between $6,000 and $8,000. That does not include property taxes, homeowner’s insurance, or maintenance, which can add thousands more per year.

In many cases, HENRYs are “house poor.” Most of their after-tax income is devoted to keeping up with mortgage, taxes, and the cost of maintaining their property. As property taxes and insurance rates continue to rise, even a strong income can struggle to keep pace with the monthly outflows.

Student Loans and the Long Tail of Education Debt

The vast majority of HENRYs have invested heavily in their education. Medical, law, and graduate degrees are expensive, and student loan balances of $100,000 to $250,000 are common for households in this bracket. Despite making high monthly payments – often $800 to $2,500 per month – many HENRYs find it will take years, sometimes decades, to pay off these loans, especially when balancing mortgage and family expenses.

For those with children, the challenge does not end there. Private school tuition for one child can easily exceed $25,000 per year in a major city. College costs are rising as well, with projected four-year expenses at a private university often landing between $300,000 and $500,000 per child. Saving for both your own retirement and your children’s education is a daunting task, even with a six-figure income.

Childcare, Healthcare, and the Cost of Raising a Family

Childcare is the second largest monthly expense for many HENRY families, especially if both parents work full time. In New York City or San Francisco, full-time daycare or preschool can cost $2,500 to $4,000 per month for one child. Aftercare, camps, and babysitting fees add even more. Unlike middle-income families, HENRYs rarely qualify for childcare tax credits or subsidies.

Healthcare is another unrelenting cost. Even with employer coverage, annual premiums for a family plan routinely top $14,000, and high deductibles mean that one medical event can disrupt a year’s budget. Out-of-pocket maxes for a single family can approach $8,000 or more.

For families with active children, extracurriculars, tutoring, and camps can easily add $500 to $2,000 per month. While these expenses are optional, many HENRYs feel cultural or professional pressure to provide every possible advantage.

The “Working Rich” Trap: Debt, Credit, and the Illusion of Affluence

While HENRYs own homes and have good credit, a surprising number carry significant debt loads beyond their mortgage. Car payments of $700 to $1,200 per month are not unusual. Some use home equity lines or personal loans to bridge the gap between income and lifestyle spending. Credit cards are often used for points or cash back, but balances can linger if cash flow gets tight.

Despite these high incomes, surveys show that more than 70 percent of HENRYs have less than six months of expenses saved outside of retirement accounts. Investments in taxable accounts are often limited, with the bulk of wealth tied up in home equity or workplace retirement plans. Many HENRYs are only one or two financial surprises away from real stress.

HENRY Income vs. Wealth: Breaking Down the Paradox

Many people assume that a high income automatically leads to wealth, but for millions of HENRYs, that is not the case. There is a persistent gap between what comes in and what actually gets built as lasting net worth. This gap is the heart of the “High Earner Not Rich Yet” paradox.

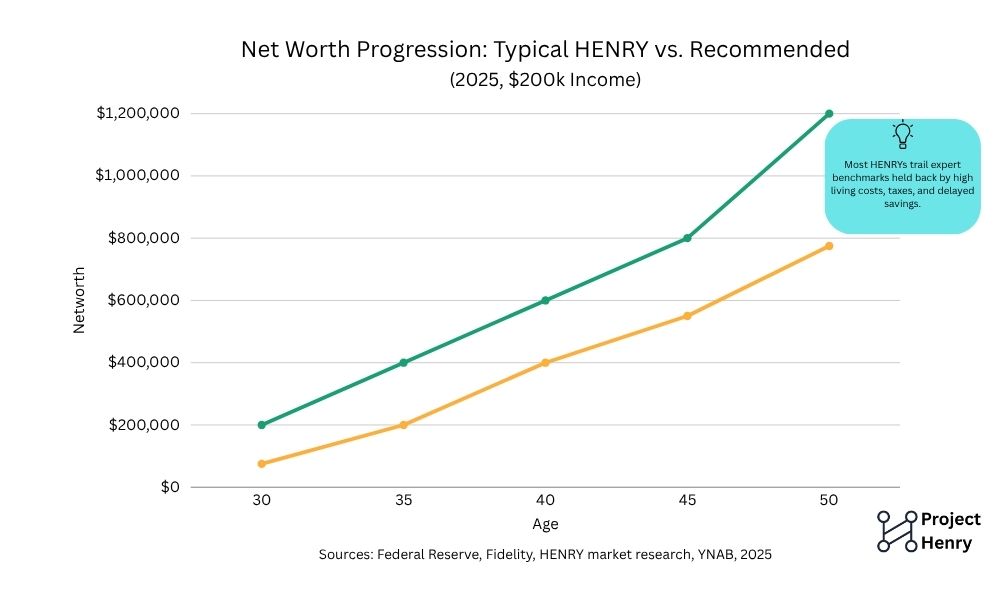

Net Worth Benchmarks by Age and Income

The numbers often surprise people outside the HENRY demographic. National data from the Federal Reserve and various private wealth studies show that most Americans with six-figure incomes still have less than $500,000 in net worth well into their late 30s or early 40s. For example, in 2025, the median net worth for US households making between $150,000 and $300,000 is roughly $340,000 for those aged 35 to 44. By comparison, the average net worth is skewed higher by outliers who inherit money or experience extraordinary investment gains.

In the HENRY demographic, a significant portion of assets are often tied up in home equity and retirement accounts, with relatively little in liquid or taxable investments. Many HENRYs do not feel comfortable or “wealthy” until they have $2 million or more in net assets, a figure that can feel impossibly distant when expenses are high.

| Age | Median Net Worth (All US Households) | Median Net Worth (HENRYs, $150k+) |

|---|---|---|

| 30–34 | $61,000 | $120,000 |

| 35–44 | $135,000 | $340,000 |

| 45–54 | $247,000 | $620,000 |

| 55–64 | $364,000 | $1,050,000 |

Source: Federal Reserve Survey of Consumer Finances, 2022–2023; estimates for 2025 reflect continued HENRY cost-of-living pressures.

Savings Rates, Cash Flow, and Investment Patterns

Despite high earnings, HENRY households frequently report that saving 15 to 20 percent of their income feels like a struggle, especially in high-cost metro areas. Many manage to save only 8 to 12 percent of take-home pay, with the remainder absorbed by mortgage, childcare, debt payments, and lifestyle costs. Large, irregular expenses – such as home repairs, medical bills, or school fees – can quickly erode savings plans.

The “forced savings” of retirement plans (401k, 403b, 457, or IRA) helps, but HENRYs often miss out on additional tax-advantaged moves like backdoor Roth IRAs or health savings account (HSA) investing. Most have less than $100,000 in liquid taxable investments by age 40, even if their 401k balance is growing. When home values are volatile, net worth can swing by tens of thousands on paper, but that does not translate to true spending power.

Why Making $200k Doesn’t Guarantee Wealth

The big salaries of HENRYs mask huge outflows. As shown in the previous section, fixed costs eat up a massive share of net pay. After taxes, housing, and essentials, many HENRYs are left with a few thousand dollars per month – or less – for building wealth. If the family faces job loss, medical expenses, or a dip in the housing market, their financial foundation can suddenly look shaky.

Many HENRYs also delay investing aggressively in the early years due to student loans or the desire to buy a home, which can mean missing the benefits of long-term compounding. Others are conservative by nature, holding too much in cash or low-yield savings, especially after volatile years in the stock or housing markets.

Real-Life Example: HENRY Doctor in New York

Consider a married couple in New York City: one is a hospitalist earning $210,000, the other is a school administrator at $90,000, for a combined income of $300,000. Their take-home pay after federal, state, and city taxes is about $192,000. They pay $7,200 per month for a modest mortgage, $3,400 for daycare, $1,200 for health insurance, and $1,000 on student loans. By the end of the month, they save less than $2,000 – barely enough to max out retirement contributions, and far from enough to reach the “millionaire next door” status. Despite their high salaries, their net worth is $320,000, mostly in home equity and retirement plans.

This story is common. Across all HENRY professions – whether in tech, law, finance, or healthcare – the math rarely leaves room for rapid wealth accumulation, unless the family makes drastic lifestyle changes or receives outside help.

Where Does the Money Go? Typical HENRY Spending

- Housing: 30 to 40 percent of gross income, sometimes more in expensive cities

- Taxes: 25 to 35 percent, depending on state

- Childcare/education: 10 to 20 percent for families with kids

- Healthcare, insurance, debt payments: 10 to 15 percent combined

- Discretionary spending: 10 percent or more, including travel, dining, shopping, and entertainment

After accounting for all of these, true wealth-building often takes a back seat. HENRYs may have good incomes and a comfortable lifestyle, but the gap between salary and lasting net worth can remain stubbornly wide.

Retirement and Investment for HENRYs

Saving for retirement and building an investment portfolio are central concerns for HENRYs, but the standard personal finance advice rarely fits the complexity of their situation. Between high incomes, fluctuating expenses, tax phase-outs, and unique opportunities (like backdoor Roths or mega-backdoor 401k strategies), high earners need a different approach.

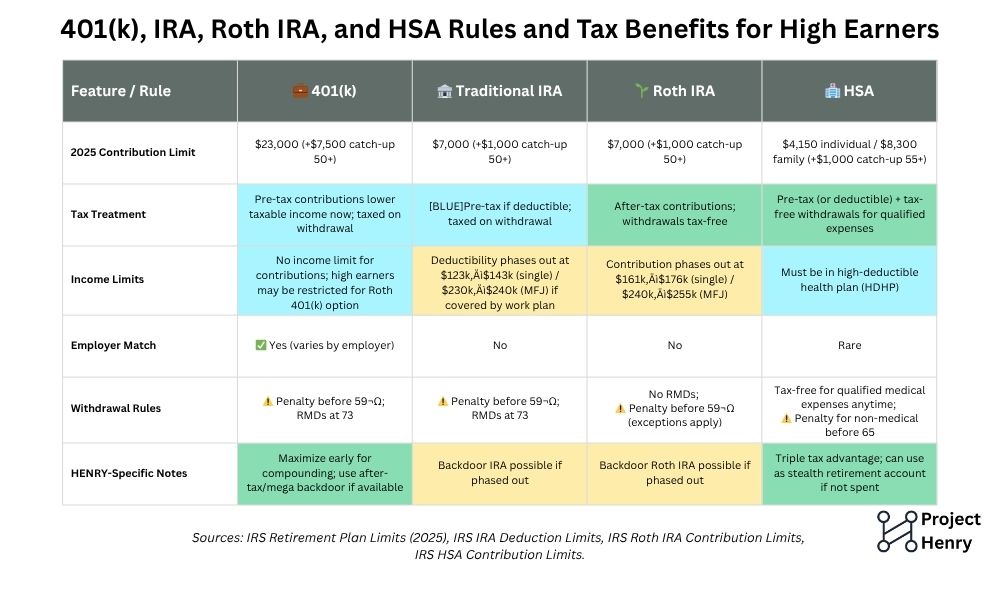

Maxing Out Retirement Accounts: 401(k), IRA, and HSA Strategies

For most HENRYs, employer-sponsored retirement plans are the backbone of their future wealth. In 2025, the 401(k) contribution limit is $23,000, with an additional $7,500 catch-up for those age 50 and older. Many HENRYs can also access a 403(b) or 457 plan, especially in healthcare or public sector jobs.

IRAs remain useful, but traditional deductible IRAs phase out quickly for high earners. In 2025, the deduction phases out completely at $143,000 modified adjusted gross income (MAGI) for singles and $228,000 for couples. Roth IRA contributions phase out at $161,000 (single) or $240,000 (married). Because of these income limits, many HENRYs use a strategy called the backdoor Roth IRA: making a non-deductible IRA contribution, then converting it to a Roth to benefit from tax-free growth.

Health Savings Accounts (HSAs) are another underused tool. For those with high-deductible health plans, the HSA allows for pre-tax contributions (up to $8,300 for families in 2025), tax-free growth, and tax-free withdrawals for healthcare. Few accounts provide this triple tax benefit, making the HSA an ideal long-term investment vehicle – even for those who can cover healthcare out of pocket today.

Advanced Moves: Backdoor and Mega Backdoor Roths, Donor-Advised Funds

Beyond the basics, HENRYs often look for advanced strategies to further boost retirement savings and lower their lifetime tax bills.

- Backdoor Roth IRA: A must for those over the income limits for direct Roth contributions. The process is straightforward, but it requires careful tracking to avoid unexpected taxes, especially if you have pre-tax IRA balances.

- Mega Backdoor Roth 401(k): Some employers allow after-tax contributions to a 401(k) beyond the $23,000 limit, up to the overall IRS maximum ($69,000 in 2025, including employer match and after-tax). These after-tax dollars can then be rolled into a Roth 401(k) or Roth IRA, creating a much larger pool of tax-free retirement savings. Not all employers offer this, so check your plan documents.

- Donor-Advised Funds (DAFs): For HENRYs interested in philanthropy, DAFs enable large charitable deductions in high-income years. You contribute cash or appreciated assets, get a tax deduction up front, and can grant money to charities over time. This is especially valuable if you expect lower taxable income or itemized deductions in future years.

The FIRE Movement: FatFIRE and CoastFIRE for HENRYs

FIRE – Financial Independence, Retire Early – has exploded in popularity, but most mainstream advice is tailored for people with much lower incomes and expenses. HENRYs who want to maintain their current lifestyle in retirement must aim for “FatFIRE,” which means accumulating $3 million, $5 million, or more before stopping work. For others, “CoastFIRE” means saving enough early so that compounding alone will get them to a comfortable retirement, even if they slow down or scale back work later.

For high earners, these targets are not impossible, but they require discipline, high savings rates, and smart tax planning. One challenge is psychological: many HENRYs find it hard to cut spending or make big life changes, even for ambitious financial goals.

Common Mistakes to Avoid

- Not maxing out all tax-advantaged accounts each year, especially when employer matches are available

- Delaying aggressive saving and investing in the early years, missing out on compound growth

- Ignoring advanced strategies like the backdoor Roth or mega-backdoor 401(k) due to lack of information or professional guidance

- Underestimating retirement spending needs, especially if children’s education or family health costs will extend into later years

Case Study: Dual-Income Tech Professionals

A married couple in Seattle, both working in tech, earn a combined $400,000. They each max their 401(k) and use the backdoor Roth IRA, set aside $10,000 per year in an HSA, and contribute to a donor-advised fund with appreciated stock from company RSUs. Even with high housing and childcare costs, these moves allow them to save over $85,000 per year in tax-advantaged accounts. Over 20 years, these choices can make a seven-figure difference in retirement readiness.

Tax Planning Strategies for 2025

Tax management is one of the most critical and complex challenges for HENRYs. High earners are impacted by unique tax rules, phaseouts, and state and local taxes that can dramatically reduce take-home pay. Being proactive is not optional. A thoughtful tax strategy can save thousands every year and accelerate the path to real wealth.

2025 Tax Landscape for High Earners

In 2025, the top federal income tax brackets remain 32, 35, and 37 percent. Many HENRYs land in the 32 or 35 percent brackets after pre-tax contributions. If you live in a high-tax state like California, New York, or New Jersey, state income tax can add 6 to 13 percent more. Some cities (like NYC) add another layer of tax.

The $10,000 cap on state and local tax (SALT) deductions remains in place. Most HENRYs do not qualify for child tax credits, student loan interest deductions, or certain education and dependent care credits due to income phaseouts. These factors mean your real marginal tax rate can approach or exceed 40 percent.

The Alternative Minimum Tax (AMT) continues to affect high earners, especially those with incentive stock options, high property taxes, or significant miscellaneous deductions. AMT is triggered when certain deductions and exemptions put your regular tax below a minimum level set by the IRS.

Key Strategies for Lowering Your Tax Bill

Max Out All Tax-Advantaged Accounts

Contribute the maximum allowed to your 401(k), 403(b), 457, or equivalent. If you are eligible for a health savings account (HSA), contribute the maximum there as well. Take advantage of backdoor Roth IRA strategies if your income is above the Roth contribution limit.

Review Withholding and Estimated Payments

Check your federal and state tax withholding. Many dual-income families are under-withheld, which can lead to penalties or an unexpected bill at tax time. Adjust payroll withholding or make quarterly estimated payments if needed.

Optimize Investment Accounts

Hold tax-inefficient investments (such as bonds and REITs) in tax-advantaged accounts. Use taxable brokerage accounts for tax-efficient index funds and ETFs. If you have stock-based compensation, work with a tax professional to plan option exercises and manage RSUs or ESPPs to minimize tax surprises.

Consider Charitable Giving Strategies

Donor-advised funds (DAFs) allow you to “bundle” donations for a larger deduction in a single tax year. Donating appreciated assets (such as stocks or mutual funds) can also avoid capital gains taxes.

Take Advantage of Tax-Loss Harvesting

If you have taxable investments, use tax-loss harvesting to offset gains and reduce your overall tax bill. Review your portfolio each year to see where losses can be realized for tax benefit.

State and Local Tax Strategies

If you are mobile or considering a move, compare the total state and local tax burden for your income and family size. States with no income tax (like Texas, Florida, or Washington) often have higher property or sales taxes. Use online calculators to estimate your all-in tax cost before relocating.

Plan for the AMT

Be aware of AMT triggers, including high state and local taxes, large miscellaneous deductions, and incentive stock options. If you are likely to be affected, plan option exercises and deduction timing with your CPA to avoid costly mistakes.

Compliance Reminder

Tax laws change frequently and can vary widely by state and local jurisdiction. Always consult a qualified tax professional or CPA before making major decisions. This guide is for informational purposes only.

Family, Kids, and Future Planning

For most HENRYs, family is both the motivation for their hard work and the source of many financial pressures. Raising children in the United States – especially in a high-cost metro – means balancing the desire to give kids the best opportunities with the reality of soaring costs, limited tax breaks, and complex planning decisions.

Saving for Education: 529 Plans and Private School

529 College Savings Plans:

A 529 plan is one of the most effective ways for high earners to save for their children’s college costs. Contributions grow tax-free and withdrawals for qualified education expenses (tuition, room, board, books) are also tax-free. Many states offer a state income tax deduction or credit for 529 contributions, although this benefit phases out for the highest earners in some locations.

Given that four years at a private university can cost $300,000 or more per child, starting early is essential. A well-funded 529 plan can ease the burden when tuition bills arrive and can sometimes be used for K-12 private school tuition (up to $10,000 per year per child), depending on state rules.

Private and Independent School:

For families in major cities, private K-12 school tuition is often $25,000 to $50,000 per year, with additional costs for activities, transportation, and fees. HENRYs rarely qualify for financial aid. As a result, paying for private education often means reducing savings elsewhere or cutting back on lifestyle spending. Some families explore alternatives like highly rated public schools or consider moving to less expensive school districts.

Childcare and Out-of-Pocket Family Costs

Childcare is frequently the second-largest household expense after housing for working professionals. Full-time daycare or a nanny in a major city can easily cost $2,500 to $4,000 a month for one child, and after-school care or summer camps add even more. Because of income limits, HENRYs generally do not qualify for the Child and Dependent Care Credit or other federal subsidies.

Healthcare is another major concern. Even with good employer coverage, annual premiums for a family plan can top $15,000, and high deductibles or co-pays can create cash flow headaches when unexpected medical events occur. Planning for these costs means building a larger emergency fund and maximizing HSA contributions if eligible.

Insurance, Estate Planning, and Generational Wealth

Life Insurance:

For families dependent on two incomes, adequate term life insurance is a must. Most experts recommend coverage of at least 7 to 10 times annual household income for each working spouse. Term insurance is usually the most affordable choice for HENRYs who want to protect their children and maintain their lifestyle if something happens.

Estate Planning:

Many high earners overlook wills, powers of attorney, and guardianship arrangements. For those with significant assets or complex family structures, a revocable trust may make sense to avoid probate and simplify the transfer of assets. Naming guardians for minor children is especially important for families with young kids.

Generational Wealth and Gifting:

If you want to help children or family members financially, understand the annual gift tax exclusion ($18,000 per recipient for 2025) and longer-term strategies for transferring wealth tax efficiently. A financial planner or estate attorney can help structure trusts, education funds, or family gifting strategies.

Work-Life Balance and Family Choices

HENRYs are often in demanding careers with long hours. Balancing career ambitions with time for family is a recurring challenge. Some choose to negotiate flexible schedules, take unpaid leave, or even step back from dual incomes for a season, despite the financial hit. Planning for these transitions requires a larger cash cushion and honest family conversations about priorities.

Mistakes, Pitfalls, and What to Avoid

High income does not guarantee financial progress. In fact, some traps are unique to the HENRY experience. Understanding these pitfalls is the first step toward building lasting wealth, reducing stress, and making the most of your earnings.

Lifestyle Creep: Spending Rises as Income Grows

For HENRYs, it’s easy to justify “reward” spending after years of hard work. The risk is that each pay raise or bonus is quickly absorbed by bigger homes, fancier cars, costlier vacations, or private schools. Over time, lifestyle upgrades become new necessities rather than special treats. This is known as lifestyle inflation or lifestyle creep.

How to avoid it:

Automate increases in saving and investing with each raise. Keep fixed expenses (like housing and car payments) as a reasonable percentage of your income, even if your paycheck jumps. Use targeted budgets for travel, dining, and shopping to avoid drifting upward each year.

Neglecting to Invest Beyond the Basics

Many high earners diligently contribute to workplace retirement plans but stop there, missing other opportunities. Not opening a taxable brokerage account, failing to pursue backdoor Roth IRAs, or leaving employer stock unexamined are common mistakes. Some HENRYs keep too much in checking or savings out of habit or caution, which stunts long-term growth.

How to avoid it:

Review all available tax-advantaged accounts annually. Once your 401(k), HSA, and Roth are maxed, set up regular investments to a low-cost taxable brokerage account. Periodically rebalance your investment mix, and consider consulting a fee-only financial advisor for guidance on stock options or alternative investments.

Missing Key Tax Moves or Failing to Plan

Tax rules for high earners are complex and change regularly. Common errors include missing the window for tax-loss harvesting, waiting until December to realize capital gains or deductions, or simply not tracking income and deductions well enough to optimize for AMT or state-specific issues. Many HENRYs also overlook charitable giving or donor-advised funds as a strategy to lower taxable income.

How to avoid it:

Plan ahead. Mark your calendar for quarterly tax reviews, especially if you have variable income or investments. Work with a qualified tax professional who understands the issues specific to high earners. Download and use a tax optimization checklist every year.

Underinsuring or Ignoring Estate Planning

Busy professionals sometimes neglect life, disability, or umbrella insurance, assuming employer-provided benefits are enough. Others put off making a will or naming guardians for children, risking confusion or costly probate issues later.

How to avoid it:

Annually review your insurance coverage and update beneficiaries. Calculate if your family could sustain its lifestyle if something happened to one earner. Consult with an estate attorney to create or update a basic estate plan. Do not wait until a major life event forces action.

Allowing Decision Fatigue and Analysis Paralysis

HENRYs face endless choices – where to save, how to invest, which schools or neighborhoods to choose, what job moves to consider. With so many options and so much at stake, it is easy to feel stuck or avoid making decisions altogether, which can lead to missed opportunities or expensive defaults.

How to avoid it:

Automate as many decisions as possible. Set up recurring transfers for saving and investing, use default fund selections for retirement accounts, and create checklists for annual reviews. Seek out professional advice when you reach a sticking point. Remember: done is better than perfect.

Digital Tools and Calculators for HENRYs

High-income professionals are time-starved and decision-weary, so using the right digital tools is essential for managing, optimizing, and tracking your finances. The best tools automate the grunt work, provide clear visualizations, and help you make smart choices faster.

Salary and Take-Home Pay Calculators

Before making any major financial decision, understand your true after-tax income. Use state and city-specific calculators to project net pay, especially after annual raises, bonuses, or job changes. This is especially important for HENRYs facing complex tax situations or living in high-tax metro areas.

Recommended Tools:

Cost of Living and Relocation Tools

Thinking about moving for a job, quality of life, or to save on taxes? Compare housing, taxes, childcare, and everyday expenses with cost-of-living calculators. HENRYs can save or lose tens of thousands a year based on location.

Recommended Tools:

Budget, Cash Flow, and Net Worth Trackers

With multiple income streams, investments, and high expenses, manual spreadsheets rarely cut it. Modern tools help HENRYs track net worth, spot trends, and automate bill paying and budgeting.

Recommended Tools:

- YNAB (You Need a Budget)

- Monarch Money

- Tiller (automates spreadsheets)

- Empower (formerly Personal Capital) for net worth tracking

Retirement and FIRE Calculators

Know if you’re on track for your goals. FIRE calculators let you model various savings rates, investment returns, and withdrawal strategies. HENRYs benefit from calculators that include tax, healthcare, and education costs.

Recommended Tools:

Investment and Tax Optimization Tools

Automated investment platforms, robo-advisors, and tax-loss harvesting services can save you time and maximize after-tax returns.

Recommended Tools:

- Betterment and Wealthfront (robo-advisors with tax features)

- Vanguard and Fidelity brokerage platforms

- TurboTax Premier or CPA services for tax optimization

Specialized Tools for HENRYs

- Student Loan Repayment Calculators: For evaluating payoff versus investing strategies (StudentAid.gov, Credible)

- Childcare and Private School Cost Calculators: For planning education expenses

- Mortgage and Affordability Tools: Bankrate and Zillow calculators

Centralized Digital Dashboard

Many HENRYs prefer to centralize their finances with a digital dashboard – linking accounts, investments, debts, and spending. This “single pane of glass” view makes it easier to manage complexity. So I recommend either building one yourself or investing in one over the longer term.

FAQ: HENRYs in 2025

Related Guides, Next Steps, and Conclusion

You’ve seen how being a HENRY in 2025 is more complex – and more common – than most people realize. High earners face unique pressures, high expectations, and the constant challenge of translating strong income into real financial security. The good news: with the right strategies and support, HENRYs can overcome these hurdles and build a wealthier, more confident future.

Related Guides and Resources (coming soon!)

Deepen your knowledge and get personalized strategies with these guides:

- Cost of Living in NYC on $150k: What You Can Afford

- How to Maximize Your 401(k) Contributions as a High Earner

- The Complete Guide to AMT for Professionals

- FIRE Planning for HENRYs: Step-by-Step

- Net Worth Benchmarks by Age and Profession

- Best Cities for HENRYs: Relocation and Tax Guides

- Profession-Specific Financial Playbooks: Doctor, Lawer, Tech, and More

Tools and Downloads (coming soon!)

- Download: HENRY High Earner’s Budget Template (Excel/Google Sheets)

- Download: 2025 High Earner Tax Optimization Checklist (PDF)

- Download: Family Planning & Childcare Budget Worksheet

- Try: HENRY Take-Home Pay Calculator

- Try: FIRE Timeline and Net Worth Progression Calculators

Join the HENRY Insider Community

Don’t miss weekly advanced strategies, city spotlights, and real-world money moves:

Sign up for our HENRY Insider email newsletter to get exclusive content, new tools, and first access to lead magnets – no spam, ever.

Join HENRY Insider (coming soon!)

Affiliate Offers (Transparency)

Some links in this guide are for high-value partners, including investment platforms, mortgage brokers, and digital financial tools. We only recommend resources that fit the needs of US high earners. Any affiliate commissions help keep our research free for HENRYs. See our Affiliate Disclosure.

Compliance and Disclaimer

This article is for informational purposes only and does not constitute personal financial, tax, or legal advice. Financial decisions should be made in consultation with a qualified financial planner, tax professional, or attorney who understands your unique situation. All figures and regulations cited are current as of 2025 and subject to change.

Final Word

If you recognize yourself in this guide, you’re not alone – and you are not failing. The HENRY path is demanding, but with careful planning, the right tools, and a supportive community, you can convert high income into lasting wealth, security, and satisfaction.

Ready to take the next step?

- Download your free resources.

- Try our calculators.

- Join the HENRY Insider community.

- Explore related guides tailored to your profession and city.

We’re here to help you make the most of every dollar, every year.

Need more depth on a topic, want a personalized plan, or have a feedback request?

Contact our team, or check out our city and profession-specific clusters for a truly custom approach.

Thank you for reading – here’s to building your financial future, on your terms.